Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound – Gold is able to sustain above downtrend channel after 4 months while silver is on the verge of crossing the downtrend line

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year-end.

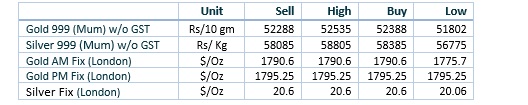

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

All eyes on US CPI numbers today

- International News – For precious metals, the CPI data and Jackson Hole will be important. For today’s inflation data, a higher-than-expected reading could be the catalyst for a final shake-out of stubborn and stale shorts within the volatility ahead of the next significant move to the downside.

- Economic Data – Combined with last week’sNFP report, the FED is expected to hike interest rates by another 75 basis points at the next Fed meeting in September

- Domestic News – If there is a pop-up in geo-political issues, then this will help gold, but it won’t be a sustained rally … The next catalyst for gold prices will be (the) U.S. CPI print coming out this week