-

gold and silver – kya lagta hai

short-term view (up to 1 week) – Weakness– Gold has broken support at downtrend channel again, while Silver is continuously trading below its downtrend line from last 5 months

Long-term view (3-4months) – positive – – – Any dips towards 50000 and 52000 should be used as buying opportunities for the target of 55000 and 60000 for Gold and Silver respectively by year end.

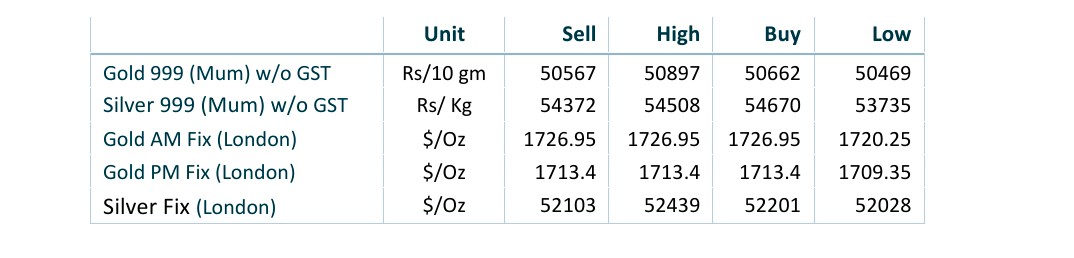

spot prices

spot gold daily price chart

spot silver daily price chart

Important news and triggers

All eyes on US CPI this week

- International news – The precious metal is facing a sell-off heat to lower consensus for the US CPI. As per the market estimates, the US inflation will land at 8.1%, 40 basis points lower than the prior release. The households in the US economy are facing the headwinds of soaring price pressures for a prolonged time.

- Demand and Supply – – The Fed is largely expected to deliver a 75-basis point rate increase later this month. The U.S. central bank has raised its benchmark overnight interest rate by 225 basis points in total since March to fight soaring inflation.

- Economic data – – – Lower consensus for US CPI is resulting in a sell-off in the precious metal. The headline US CPI is seen lower at 8.1% vs. 8.5% reported earlier.

- Indian Demand – India’s gold imports in August halved from a year earlier to 61 tonnes as volatile local prices and a weak rupee prompted consumers to postpone purchases.