Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Negative– Gold and Silver prices are continuously getting support on uptrend line. As prices have runup too fast, some profit-booking is expected.

Long-term View (3-4months) – Positive – – Gold has made Inverse Head and Shoulder pattern on daily charts. Neckline resistance is $1820. If prices sustain above it, target would be $2020.

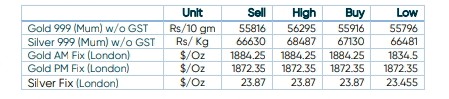

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

All eyes on US Inflation data

- International News – Investors remain in an upbeat mood going into today’s US inflation report, buoyed still by the December jobs report and the prospect of the economy being less squeezed by interest rates

- Economic data – The market expects the inflation rate to have fallen from 7.1% to 6.5%. US inflation data could lend further tailwind to the gold price given that the slowing of inflation that has been observed since the summer is likely to have continued last month.

- Growth – World Bank economic forecasts add strength to the gold price even if US Dollar probes buyers. World Bank stated that it expects the global economy to

grow by 1.7% in 2023, down sharply from 3% in June’s forecast.

1 Comment. Leave new

Your article helped me a lot, is there any more related content? Thanks!