Currently, paper gold is not a 1st tier asset. Only fully allocated physical bullion that has no counterparty risk attached that qualifies as a first-tier asset. Basel III rules coming into effect in June 2021 through to January 2023 will eliminate any valuation haircut. The new rules will require a provable 1:1 ratio of fully allocated gold reserves, with no counterparty risk. Under Basel III rules, every central bank will be able to revalue its physical reserves higher, from a current 50% haircut into a fully cash exchangeable asset. Read more and know about Basel III and its impact on gold.

Background

The Basel Committee on Banking Supervision was formed in 1974 by central bankers from the G10 countries, who were at that time working towards building new international financial structures to replace the recently collapsed Bretton Woods system. The Basel Committee is made of up Central Banks from 28 jurisdictions.

The committee is headquartered in the offices of the Bank for International Settlements (BIS) in Basel, Switzerland. Member countries include Australia, Argentina, Belgium, Canada, Brazil, China, France, Hong Kong, Italy, Germany, Indonesia, India, Korea, the United States, the United Kingdom, Luxembourg, Japan, Mexico, Russia, Saudi Arabia, Switzerland, Sweden, the Netherlands, Singapore, South Africa, Turkey, and Spain.

The BCBS has developed a series of highly influential policy recommendations known as the Basel Accords.

- The first Basel Accords, or Basel I, was finalized in 1988 and implemented in the G10 countries, at least to some degree, by 1992. It developed methodologies for assessing banks’ credit risk based on risk-weighted assets and published suggested minimum capital requirements to keep banks solvent during times of financial stress.

- Basel II expanded rules for minimum capital requirements established under Basel I, the first international regulatory accord, and provided the framework for regulatory review, as well as set disclosure requirements for assessment of capital adequacy of banks. The main difference between Basel II and Basel I is that Basel II incorporates credit risk of assets held by financial institutions to determine regulatory capital ratios, which was in the process of being implemented when the 2008 financial crisis occurred

- Basel III attempted to correct the miscalculations of risk that were believed to have contributed to the crisis by requiring banks to hold higher percentages of their assets in more liquid forms and to fund themselves using more equity, rather than debt. It was initially agreed upon in 2011 and scheduled to be implemented by 2015, but as of December 2017 negotiations continue over a few contentious issues.

Deferment for Basel Implementation

In 2018, the Committee started assessing the consistency of implementation of the NSFR and the LEX framework. As of end-May 2020, reviews of the implementation of these standards in Argentina, Australia, Brazil, Canada, China, Hong Kong SAR, India, Indonesia, Saudi Arabia, and Singapore have been completed and the reports published. Overall, the NSFR regulations and the LEX framework in these jurisdictions were found to be “compliant” with the Basel standards

In March 2020, the GHOS endorsed a set of measures to provide additional operational capacity for banks and supervisors to respond to the immediate financial stability priorities resulting from the impact of Covid-19 on the global banking system. These include:

- Deferment of the implementation date of the Basel III standards finalized in December 2017 by one year to 1 January 2023. The accompanying transitional arrangements for the output floor have also been extended by one year to 1 January 2028.

- Deferment of the implementation date of the revised market risk framework finalized in January 2019 by one year to 1 January 2023.

- Deferment of the implementation date of the revised Pillar 3 disclosure requirements finalized in December 2018 by one year to 1 January 2023.

New Rules for Banks

Previously, banks could hold gold on their balance sheets in the form of unallocated paper gold contracts without holding physical gold in tangible form. These paper contracts were considered as “good as gold” when it came to determining how much capital a bank needed to maintain on its balance sheet. Under the old rules, there was little incentive to hold physical gold, as it was only valued at 50% for reserve purposes.

Gold was previously viewed as a risky asset. It was classified as a Tier 3 asset, which meant that gold could only be carried on banks’ balance sheets at 50% of the market value for reserve purposes. If a bank owned a $1m of gold and its capital adequacy ratio was 10%, then the required capital the bank needed was $1m x 50% (risk weighting) x 10% (capital adequacy ratio) equals $50,000.

Basel III rules move physical gold from being considered a Tier-3 asset to being considered Tier-1, which allows physical gold in bullion form to be counted at 100% value for reserve purposes. Gold in unallocated paper contracts will no longer be considered an equal asset. For this reason, banks using paper forms of gold to help meet reserve requirements will have to convert those positions to physical metal, or risk becoming too undercapitalized to continue to function.

What does Basel III mean for banks’ gold reserves?

Currently, paper gold is not a 1st tier asset. Only fully allocated physical bullion that has no counterparty risk attached that qualifies as a first-tier asset. As we mentioned earlier, Basel

III rules coming into effect in June 2021 through to January 2023 will eliminate any valuation haircut. The new rules will require a provable 1:1 ratio of fully allocated gold reserves, with no counterparty risk. Under Basel III rules, every central bank will be able to revalue its physical reserves higher, from a current 50% haircut into a fully cash exchangeable asset.

It is believed that central banks will be able to pay off massive swathes of debt by revaluing gold. Gold would not only act as a cash asset, but would also behave central banks to revalue the dollar price of gold.

While full implementation of the Basel III rules has been pushed back until January 1, 2023, the largest players in the gold market (USA, Switzerland, EU nations) have targeted June 28, 2021 as the date by which they plan to be in compliance.

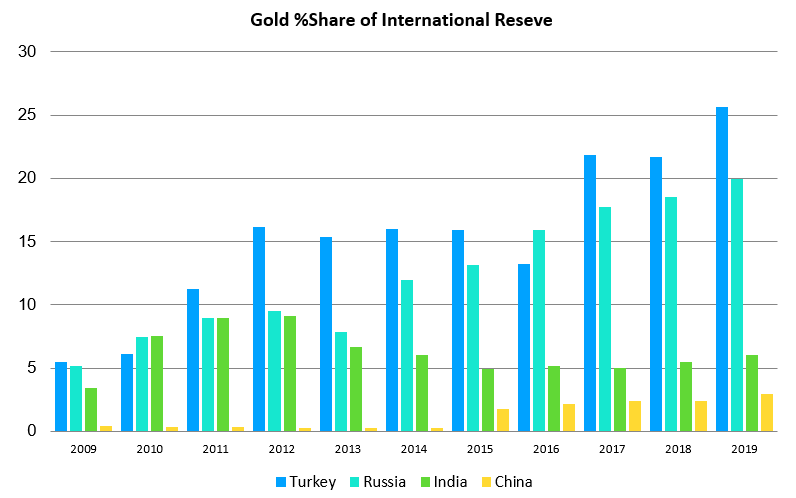

Most of the emerging market countries are multiplying their Gold reserves from the last 10 years as Basel III rules will lead to a sanctioned gold revaluation, while ultimately driving a more physical market.

1 Comment. Leave new

rqbQ