Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Positive – – – A small healthy correction in Gold can drive prices lower up to 53700 and 53500 Long-term View (3-4months) – Positive – – – Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

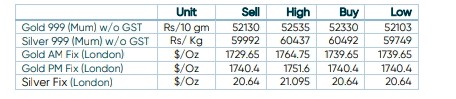

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

International News – Gold price has attempted to resurface after dropping to near $1732 as the risk-off impulse has started fading. The US Durable Goods Orders are expected to continue their pace of improvement at 0.4%. Higher demand for US Durable Goods could dent FED’s strategic plans to scale down soaring inflation.

Interest Rates – – China’s daily Covid cases jump to seven-month high, chatters over Beijing’s gold buying also underpin recovery. China imposed strict new COVID-19 measures in Beijing after the country reported its first death in almost six months.

1 Comment. Leave new

Your article helped me a lot, is there any more related content? Thanks!