• Bullion prices jumped more than 2% as the dollar fell after data showing an uptick in the U.S. unemployment rate in October raised optimism that the Federal Reserve would be less aggressive on rate hikes going forward.

• The US Bureau of Labor Statistics reported that Nonfarm Payrolls rose by 261,000 in October, surpassing the market expectation of 200,000 by a wide margin. U.S. employers hired more workers than expected in October, but a rise in the unemployment rate to 3.7% suggested some loosening in labor market conditions. “The U.S. jobs report has hit the sweet spot of what the marketplace was wanting to see and that has allowed gold prices to rally.

• The Bank of England also hiked the bank rate by 75bp to 3.0% as expected on Thursday but with a dovish tilt compared to the FED. Hence, we expect smaller hikes going forward and foresee the peak rate in February at 3.75%.

• On Wednesday, the U.S. central bank raised interest rates by 75 basis points and FED Chair Jerome Powell said it was “very premature” to think about pausing and that the peak for rates would likely be higher than previously expected. However, the trend for gold is still down. The tone of Powell on Wednesday afternoon is going to overshadow economic data for probably the near term.

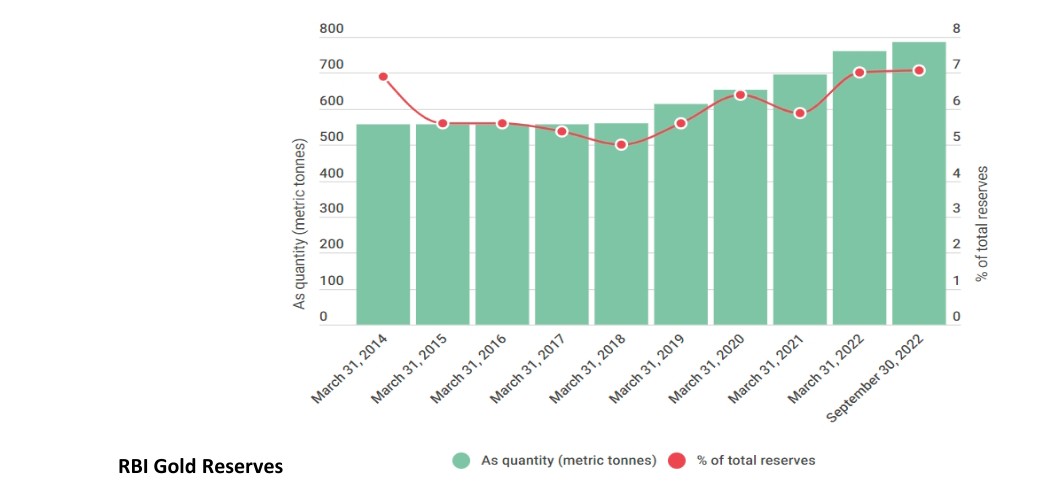

• The Reserve Bank of India’s gold reserves, which have increased by over 100 tonnes in the last two years, continued their upward trajectory in the current financial year, with the central bank adding 24.93 metric tonnes so far in the year. As at end-September 2022, the Reserve Bank held 785.35 metric tonnes of gold – including gold deposits of 41.57 metric tonnes

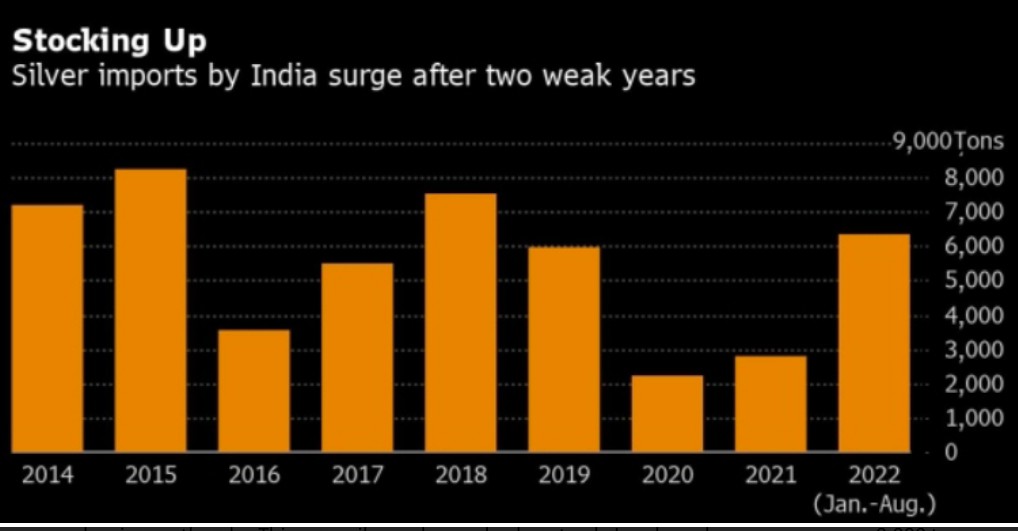

• Indian silver consumption is forecast to surge by around 80% to a record this year, as traders draw down inventories in warehouses from London to Hong Kong after two Covid-riddled years. Indians bought historically low amounts of silver in 2020 and 2021 as supply chains and demand were hit by virus outbreaks. This year, silver sales are back on track. Local purchases may surpass 8,000 tons in 2022 from about 4,500 tons last year. We are seeing a jump in purchases among retail customers, similar to what we saw in gold last year, because of pent-up demand. Imports during the January to August period were 6,370 tons compared to just 153.4 tons during the year-before period.

• Next week, the focus will be on US midterm election on Tuesday. Republicans are favoured to win control of both house and senate, although the senate race remains a close call. If republicans win the senate with a slim margin or if democrats are able to retain the senate, market reaction should be quite muted, as major changes in fiscal policy would be difficult to pass. The (modest) risk-scenario for markets would be a clear victory for republicans also in the senate, as this could increase the risk of more expansionary fiscal policies amid the looming recession. We see the risk as fairly unlikely for now, however, as politicians are likely well aware of the inflation risks.

1 Comment. Leave new

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?