By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

For global central banks, last week was a very busy week. It was a 25 basis point rate cut by the European Central Bank. Both the Bank of Canada and the Swiss National Bank chose to implement more aggressive easing in the meantime, cutting their rates by 50 basis points. Conversely, Brazil’s central bank made an extremely hawkish announcement, raising the Selic rate by 100 basis points and indicating that the next two policy meetings will see rises of the same magnitude. This week, the BoE is expected to hold the interest rates, the FED is expected to lower rates, and the BOJ must make a difficult decision either to raise rates or wait.

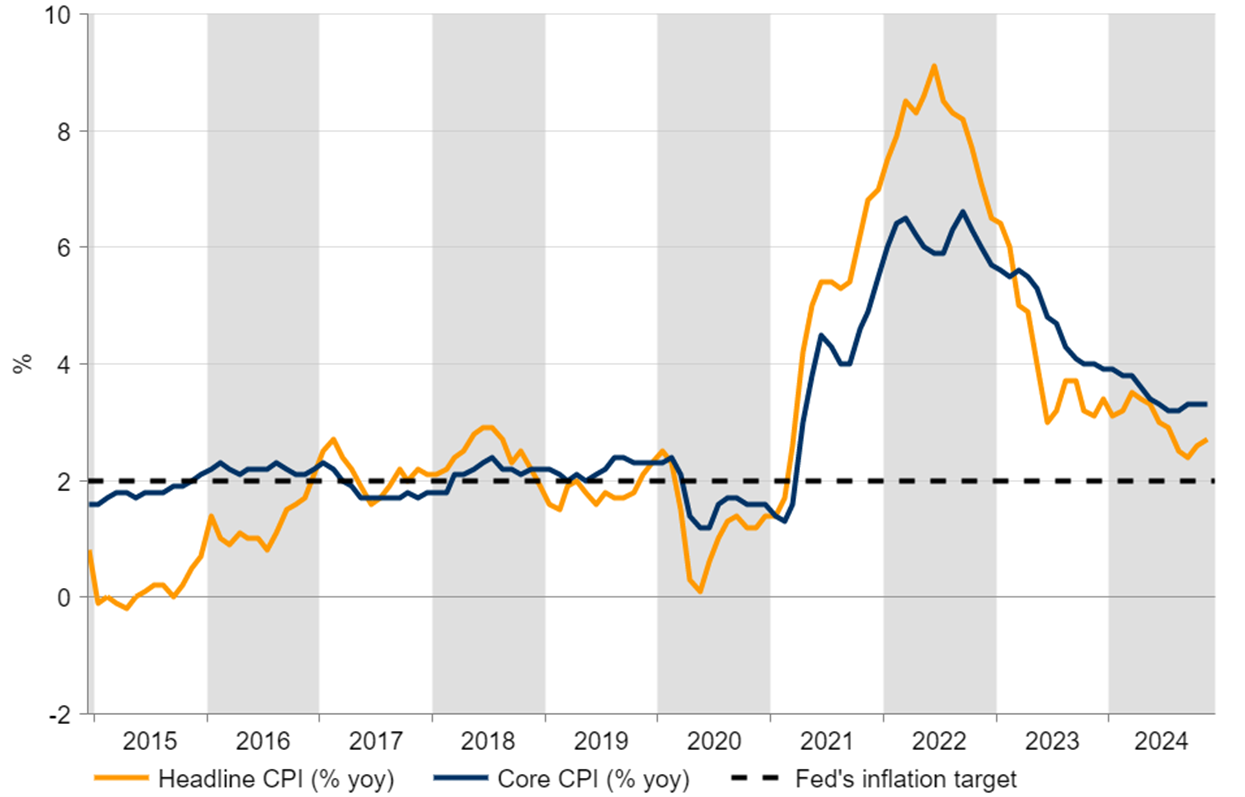

The US economy’s excellent performance supports the idea that Fed officials shouldn’t cut interest rates right away, as Fed Chair Powell himself has stated. Market participants became increasingly certain that the Fed will cut rates next week, nearly completely pencilling in a quarter-point cut, even though last week’s data indicated that US inflation was a little bit stronger than in October.

US Inflation Trend

A 25 bps drop by itself is unlikely to cause much market turbulence in light of all of that. Investors should pay closer attention to signs about the likelihood of a January pause and the number of rate cuts that policymakers are considering in 2025. However, the likelihood that policymakers will abstain in January has increased to over 80%.

The inflation outlook is made more complex by the election of Donald Trump as the next president of the United States. His suggested measures, which include business tax cuts, immigration restrictions, and import duties, are thought to have the potential to cause inflation. If put into effect, these policies might raise expenses throughout the economy and put the Fed’s goal of gradual rate drops in jeopardy.

The US Dollar Index, which is once again in the crucial region at the 107 handle, is the main focus this week. I believe that demand will be supported and that gold prices have found a floor around $2500 (~Rs 73000) for the upcoming months due to the expectation of lower interest rates, the continued elevated geopolitical risk, and the uncertainty surrounding the Trump administration’s implementation of protectionism policies.

Domestic Gold Daily Chart

Gold has been taking support at the uptrend line for the past month. If the same trend is to be followed, Gold will rebound from current levels of Rs 77100 towards Rs 79000 again. If prices sustain below Rs 77100, the next target is Rs 75000.

International Silver Daily Chart

Similarly, Silver has been consolidating in the range of Rs $32.30 (~Rs 95000) and $29.70 (~Rs 88000) over the last three months. Buy on dips around the support levels and selling on rallies around the resistance level should be the strategy used.

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.