By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

The main theme of the first week of 2025 was the strength of the US Dollar. The US Dollar Index, which measures the US dollar’s performance versus six major currencies, reached a new multi-year high of 109.56 on Thursday before dropping below 109 by the end of the week.

The US dollar has gained strength since mid-August, when it held important support at 100 points. The market’s bullish sentiment has only risen after the November election in the United States. President-elect Donald Trump’s ‘America-First’ policies are fueling anticipation of a rebound in American manufacturing, which will further promote economic development.

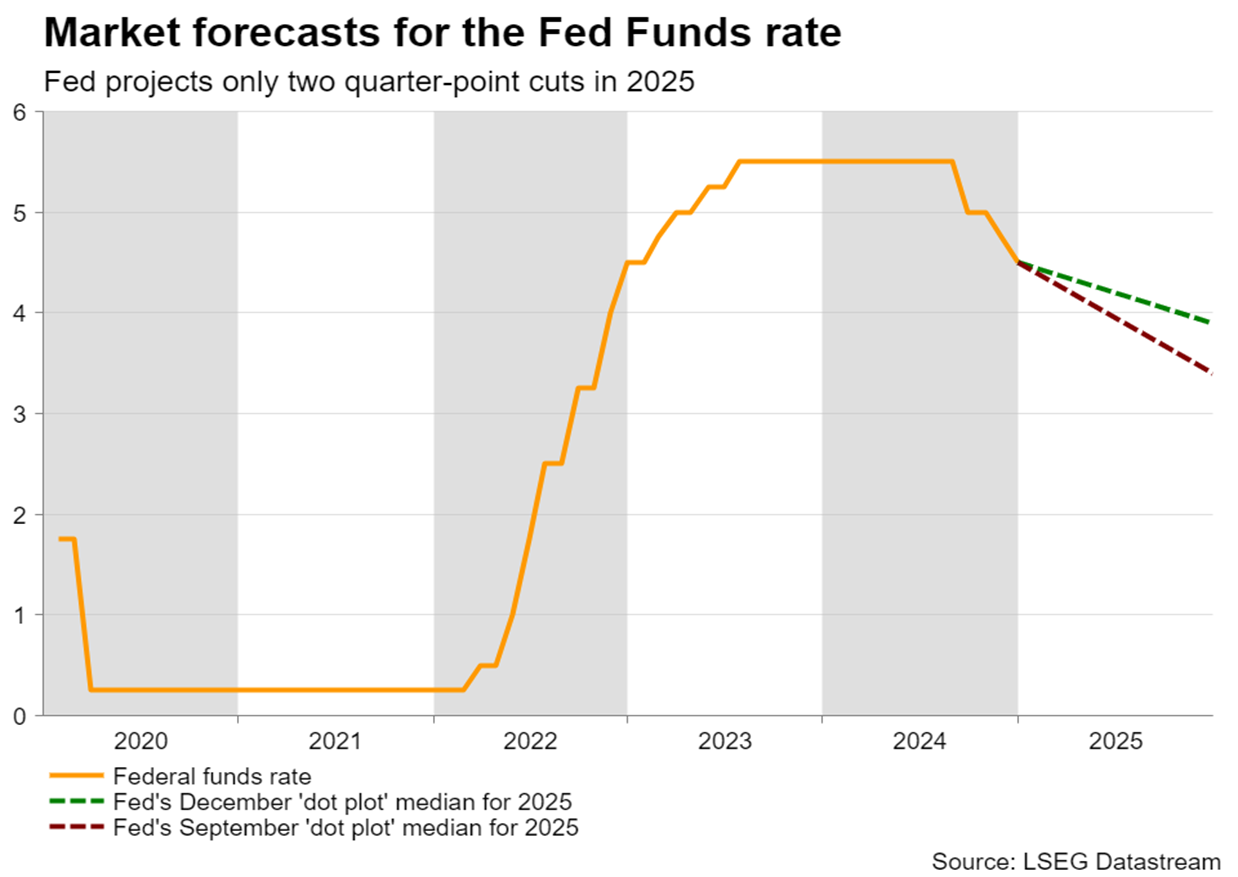

What led to this was the election of Donald Trump as US president, which raised concerns that his tariff and tax cut policies would refuel inflation. The better-than-expected economic data, and the stickiness in inflation even before Trump’s policies were enacted, have also corroborated the idea that the Fed should not be in a rush to lower interest rates further.

The strength of the Greenback may limit the upside potential of dollar-denominated gold, as a higher USD makes gold more expensive for buyers using other currencies.

Other developments include geopolitical events that have an impact on the outlook of the precious metals markets. Russia’s drone activities in Ukraine, combined with Israel’s airstrikes in Gaza, have boosted demand for the safe-haven asset.

This week’s focus will be on the US Nonfarm Payrolls jobs data, which will begin the monthly cycle of US labour stats for 2025. January has consistently seen the highest price gains in the last 20 years as investors and asset allocators build new long positions, accompanied, of course, by strong jewellery demand over the holiday season.

As suggested last week, Gold has been taking support at the uptrend line for the past two months, and the prices have indeed taken support at Rs 76000 and are on the course of touching Rs 78500 soon.

Domestic Gold Daily Chart

Similarly, Silver has been consolidating in the descending triangle with support at Rs 87000 and resistance at Rs 94000. Buy on dips in the range of Rs 87000-88000 and selling on rallies around Rs 94000 level should be the strategy used.

Domestic Silver Daily Chart

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.