Don’t put all your eggs in one basket this Easter

By Renisha Chainani, Head-Research, Augmont Gold For All

This is one of those instances when investors must ask themselves a few difficult questions. You may believe that your portfolio is well-diversified, and that it will protect you from storms. Could this, however, be a trick of the light?

‘Don’t put all your eggs in one basket,’ a fitting analogy for the Easter weekend, is often cited as a basic investment rule, but it’s not as simple as the proverb says. Many people are likely to be more ‘diworsified’ than diverse. They tend to invest in investments that are similar or ‘correlated,’ meaning they will suffer the same destiny in a downturn.

The latest Bank of America survey of the professionals showed pessimism about the global economic future, with fears of stagflation, a dangerous combination of high inflation and slow growth. Inflation in the United Kingdom topped 7% this week, while it was 8.5 percent in the United States. In the face of uncertainty, it is more important than ever to be modest – and to create a portfolio, first to survive, and then to prosper.

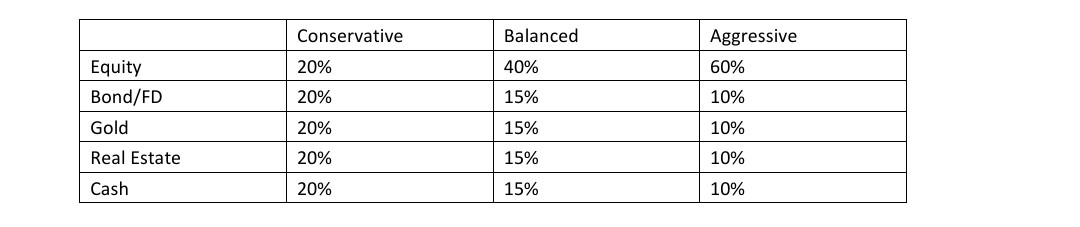

As we know, Gold has many roles to play as a safe-heaven, as a currency, as a commodity, as hedge against inflation, as hedge against uncertain times, as hedge against interest rate rise, etc. Gold should at least form 10-20% of asset allocation in a diversified portfolio. As per risk profile – asset allocation can be Conservative, Balanced, Aggressive.

Example of Asset Allocation

Diversification will not completely protect you from storms; safe havens are not invulnerable. But you’ll have some peace of mind knowing that you’ve done your best to prepare yourself and safeguard your nest egg.

Diversification will not completely protect you from storms; safe havens are not invulnerable. But you’ll have some peace of mind knowing that you’ve done your best to prepare yourself and safeguard your nest egg.

2 Comments. Leave new

One of the most important things of your blog is the quality of the content you provide.

https://askreader.co.uk/225/united-utilities-scams-in-the-uk-be-aware-and-stay-protected

Если вам нужно оперативно организовать [url=https://gruzovieshiny.ru/]доставка груза из Санкт-Петербурга в Москву[/url], наша компания предоставит выгодные услуги. Мы гарантируем сохранность вашего груза на каждом этапе доставки.