Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Having tested the 100-Simple Moving Average, now at $1738 on the four-hour chart last Friday, gold price has entered a phase of upside consolidation.

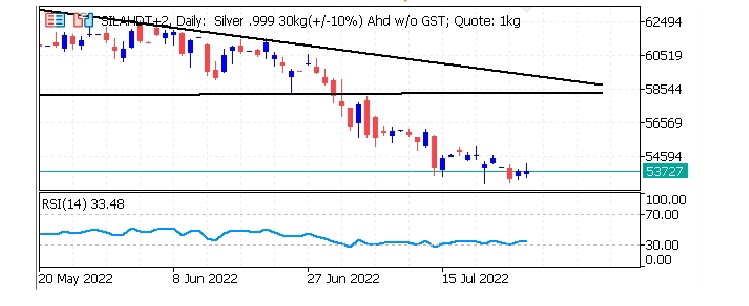

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

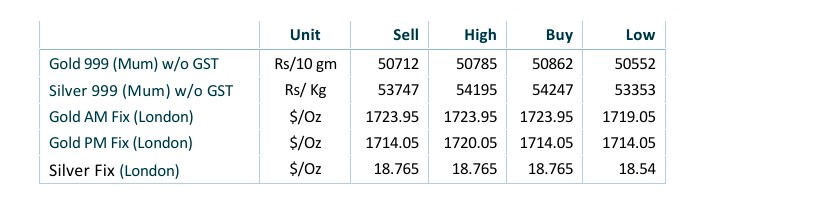

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

FED hikes 75 bps, remains highly attentive to Inflation but cautions economy softening

- International News – Precious Metal prices end higher, extend their climb as Fed lifts interest rates as expected. The Fed unanimously hiked rates by 75 basis points to a range of 2.25%-2.5%, in line with expectations. FOMC acknowledges that “spending and production have softened,” yet also affirms that “job gains have been robust in recent months.” Russia’s war in Ukraine is adding “upward pressure” on inflation as well as weighing on economic activity, the Fed says. The FOMC repeats that it’s “highly attentive to inflation risks.”