A volatile year is coming to an end, and the most important week for central banks is upon us. The Federal Reserve will lead the final rate-setting choices of 2022, which will also include the European Central Bank, the Bank of England, and the Swiss National Bank. But it’s not just central bank meetings that are clogging up the calendar. There will also be a frenzy of economic data, headlined by the latest US CPI report and December flash PMI releases.

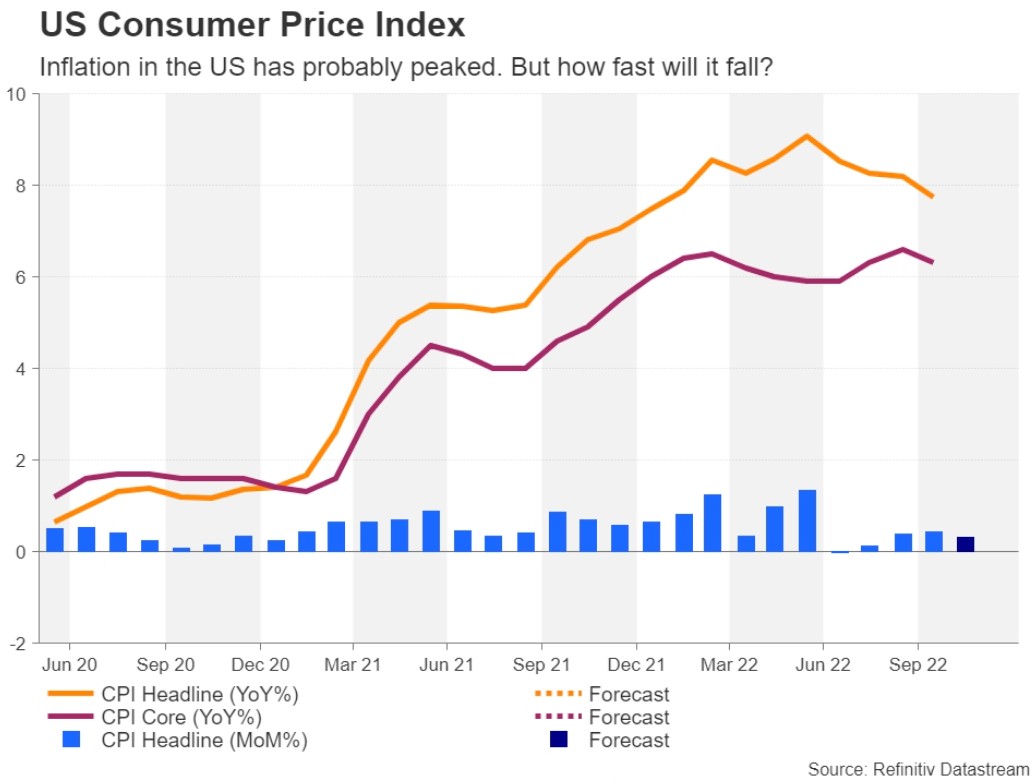

For the majority of 2022, rapid rate hikes and a rising USD have weighed on gold, leading to the most aggressive tightening of financial conditions since the Global Financial Crisis (GFC). Markets were in a “everything bear market” by the end of October. With the Fed’s aggressive, front-loaded approach to rate hikes over, central banks are likely to shift to smaller hikes over a longer time horizon. Along with peak Fed hawkishness, inflation has likely reached a near-term momentum peak, as have the USD and bond yields.

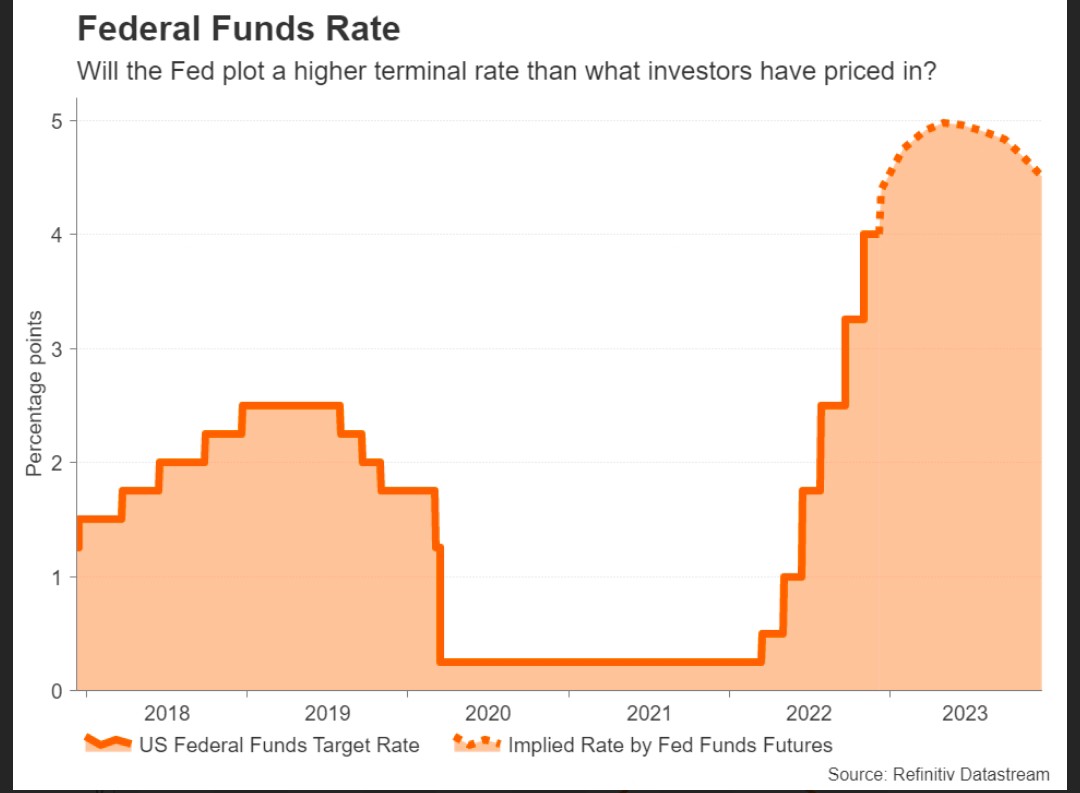

For the time being, the FED will remain as dovish as possible, as both inflation and the labour market remain too hot for policymakers’ liking. With many officials clearly signalling that the December dot plot will pencil in a terminal rate of at least 5%, investors are in for a rude awakening as futures markets see the Fed funds rate peaking just below that level. The November CPI report will be released on Tuesday, and it is expected to show a slight moderation in the month-on-month rate.

Gold and Silver will continue their northward trajectory next week too, as weekly closing is very strong. Next target for Gold is Rs 54500 and for Silver Rs 70000 in coming days.

1 Comment. Leave new

vJvu