As Russian troops entered Ukraine on Thursday morning, the gold price surged to an 18-month high of $1974/oz. And while it has given up most of Thursday’s gains as global equities rebounded, gold is still more than 5% higher month-to-date

As Russian troops entered Ukraine on Thursday morning, the gold price surged to an 18-month high of $1974/oz. And while it has given up most of Thursday’s gains as global equities rebounded, gold is still more than 5% higher month-to-date. Market has discounted geopolitical tension caused by Russia-Ukraine war and now focus has shifted towards inflation and crude oil price movement. However, they maintained that one needs to keep an eye on Russia-Ukraine news as any military action from NATO can trigger sharp upside move in the yellow metal price. As inflation has touched alarming levels, Fed may continue its hawkish stance on interest rate hike.

Meanwhile, money managers have increased their bullish gold bets by 35,336 contracts to 14-month high net-long positions to 160,982 contracts. Exchange-traded funds (ETFs) that invest in gold and other precious metals have seen massive inflows as investors rush to shield themselves against the rising geopolitical tensions between Russia and Ukraine.

Historical analysis suggests that gold has reacted positively to tail events linked to geopolitics and, despite price volatility, tended to keep those gains in the months following the initial event. Looking forward, we believe that gold may experience price volatility in either direction due to potential tactical positioning but investment demand is likely to be supported longer term by high inflation, geopolitics and overall market pullbacks.

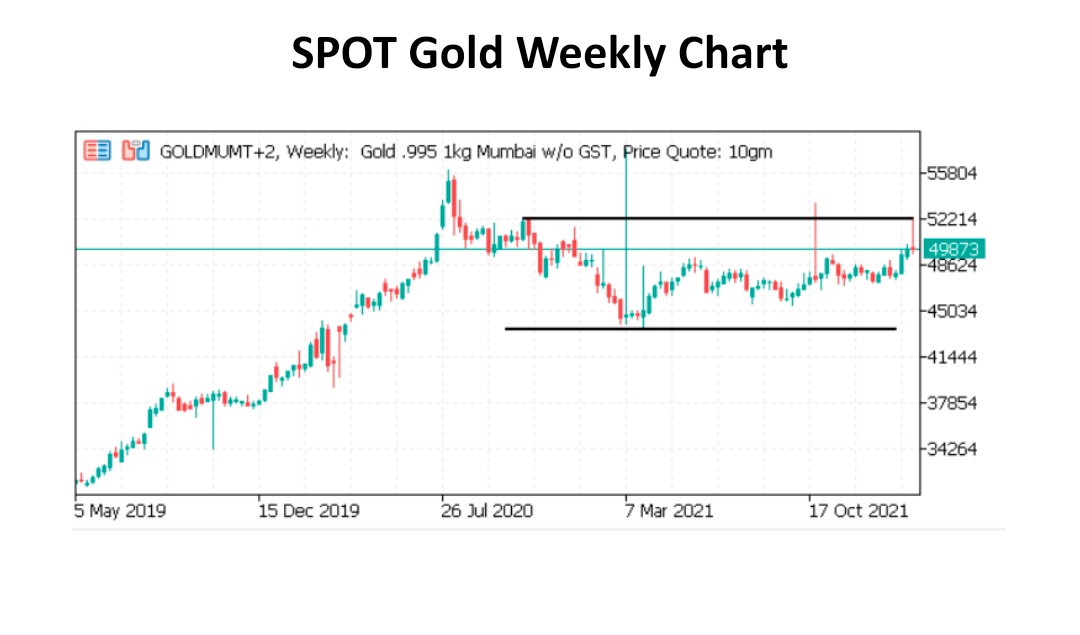

Technically, if we analysis gold weekly chart, spot gold prices have support at Rs 45500 and Rs 43700 and resistance at 50000 and 52000. As the situation in Ukraine has not eased as far as we are aware, we are finding it difficult to identify any reasons for the price fall. It is possible that some investors were forced to sell gold in order to offset losses in other asset classes. Or it may be that the sanctions imposed on Russia by the US, the EU and the UK are not felt to be tough enough … We believe it possible that the gold price will see a renewed upswing in the next few days – especially if the situation in Ukraine escalates any further.

You may also like to read: Risk-On sentiments drives Gold to touch $1900