By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

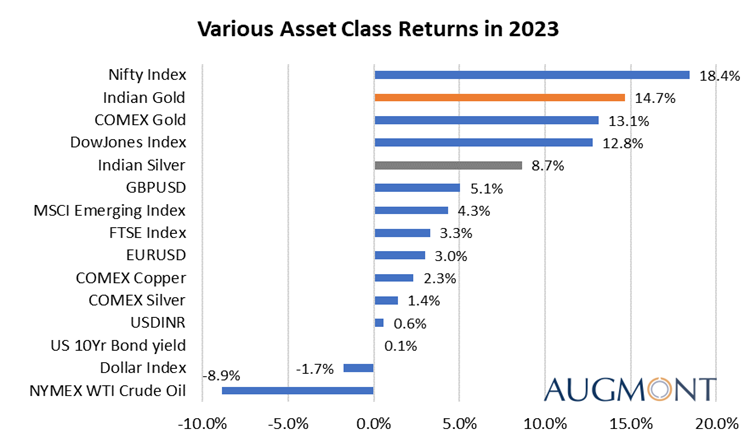

Gold had an outstanding performance in 2023, rising around 12% from $1820s to $2060s in international markets. While in domestic markets, performance has been better, with prices rising 15% from Rs 55000 to almost Rs 63000. Gold has been the best-performing metal in 2023 surpassing the returns of many other asset classes and also the recommended target of Rs 60000 last year.

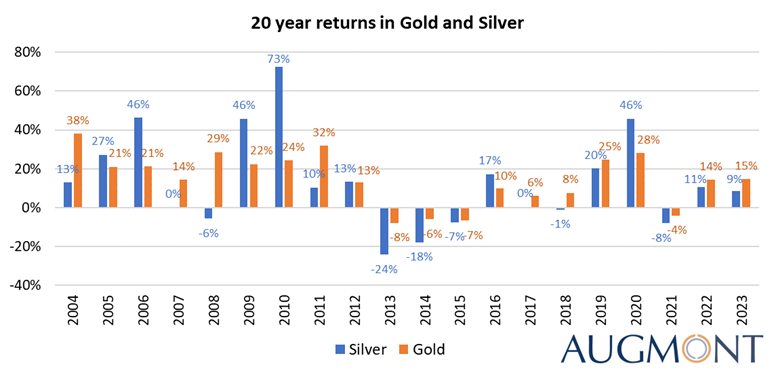

Not only in 2023, Gold has been giving consistent positive returns, if we look at its historical performance. Gold has given positive returns 80% of the time in the last 20 years with an average CAGR of 12%. While silver has given positive returns 75% of the time in the last 20 years.

In the first week of December 2023, gold prices touched a new record high of $2150/oz in international markets and Rs 64400/10 gm in domestic markets on the reemergence of Geopolitical Tensions in the Middle East and on increased speculation that FED will begin cutting interest rates from March 2024 following a series of rate hikes in the last 20 months. Prices have been well supported above $2000 after that as positive factors continue to support prices:

- Change in FED monetary stance from hawkish to dovish

- Geopolitical Tensions in the Middle East

- Rising Debt and deficits in the US

- Shrinking Balance Sheet and Money Supply in the US

- Strong Central Bank Demand and De-dollarization

From a technical perspective, Gold has created a triple top resistance around $2080 (~ Rs 63400) in the last three years. In 2023, Gold prices attempted to clear this resistance for a single day, but did not sustain. A lot of positive news, follow-through buying and fear would be required for prices to surpass that level. Once it does, though, the possibilities are that the bull run won’t end until $2300 (~Rs 70000). While on the downside, gold prices have formed a base around $1900 (Rs 58000), which would act as the floor of this bull run.

Talking about Silver, global economic movements, currency fluctuations, and geopolitical happenings all have an impact on silver market dynamics. Silver’s price is more volatile than gold’s, allowing possibilities for savvy investors to profit from market changes. Looking ahead, silver’s prospects appear rosy. Silver’s demand might increase as the globe shifts toward renewable energy and technology such as 5G, making it an even more appealing component of a well-diversified investment portfolio.

Factors that have and continue to support silver prices to stay above $24:

- Demand -Supply Deficit due to widespread Industrial Application

- 5G Technology has boosted silver demand

- Solar panel demand skyrocketing

- Electric Vehicle Market demand doubling

From the technical perspective too, I remain optimistic, predicting a 20% higher target of $30/oz (~Rs 90000) by the end of the year 2024 in Silver. In the short term, we can see prices inching towards $27/oz (~Rs 82000), which is the Inverse Head and Shoulder target. On the downside, support is $23 (~Rs 71500).

For a better risk-adjusted return portfolio, it is always advised to allocate at least 15-20% of the portfolio amount into Gold and Silver divided equally. The best way to start or stay invested in gold and silver is through Augmont Digital Gold and Augmont Digital Silver for better returns. Those who have missed this 2023 rally, can still take advantage as gold and silver prices are expected to rise 10% and 20% respectively in 2024.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice