Fundamental News and Triggers

- The gold price is consolidating near the weekly high, despite a minor USD rise and a risk-on mood. The fundamental environment is favourable to bullish traders and promotes the probability of further rise in prices. Before the US PCE Price Index, the US Consumer Confidence Index is expected to provide some momentum.

- The gold price is also looking for support from the Middle East’s ongoing geopolitical turmoil. In reaction to Israel’s assault on the Gaza Strip, Yemen’s Iran-backed Houthi rebels launched a series of drone and ballistic missile attacks on ships in the southern Red Sea. Meanwhile, Israeli strikes on the Gaza Strip continued overnight, resulting in more Palestinian casualties.

Technical Triggers

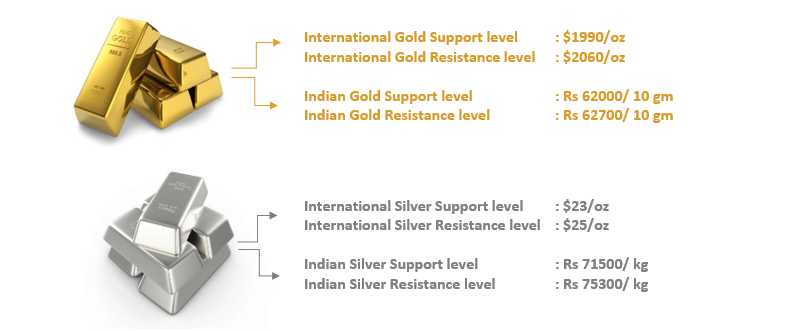

- Gold prices are trading sideways in the range of Rs 62000 and 62700, with the same rangebound momentum expected to continue.

- Silver prices are trading sideways in the range of Rs 74000 and Rs 75300, with the same rangebound momentum expected to continue.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.