Fundamental News and Triggers

• As the Dollar Index declines due to investors pulling out of the dollar due to the possibility that the FED’s current rate hike cycle will eventually come to an end, gold and silver prices rise.

• Key U.S. CPI data for June were currently being eagerly awaited by markets. While the headline inflation rate is anticipated to have decreased last month as a result of lower gasoline prices, core CPI is anticipated to have remained stable.

• Central Banks continue to buy gold in their reserves, with the biggest buyer being China. China added 21 tonnes last month and has totally added 165 tonnes last month. Total reserves now amount to 2113 tonnes.

Technical Triggers

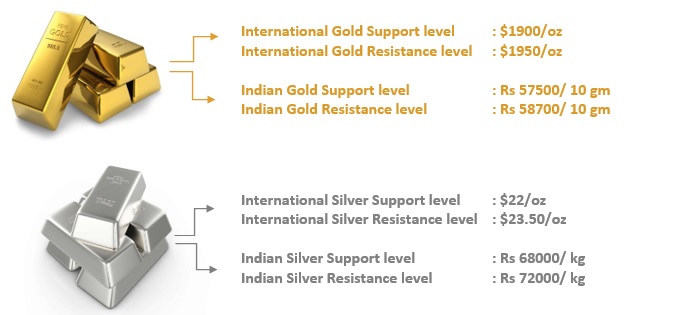

• Gold prices have rebounded from strong psychological support of $1900 (~ Rs 57500) which was also 150 DMA, the next resistance is $1950 (~ Rs 58700).

• Silver prices have very important support around $22(~ Rs 68000) which is also 200 DMA and a 50% Fibonacci retracement level of rally from $18 to $26. Prices have rebounded from that level heading towards the next resistance of $23.50 (~ Rs 72000)

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.