By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold and Silver had an outstanding 2024 with prices rising more than 25%. Gold reached an all-time high of $2800 (Rs 80000) on October 31 and Silver touched a record high of $35 (Rs 100,000) on October 23, – driven by its function as a “safe-haven” amid geopolitical and political uncertainty.

Five factors that supported gold and silver in 2024 and will continue to influence in 2025 are:

1. Monetary Easing

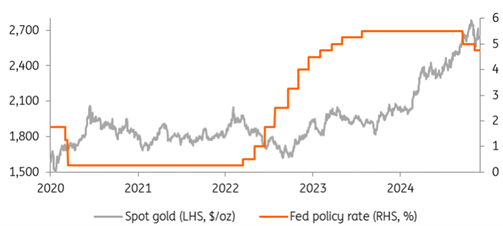

In response to slowing inflation and changing economic conditions, central banks around the world changed their monetary policy from tightening to easing in 2024, which ultimately was beneficial for precious metals. The FOMC lowered the federal funds and interest rates three times in 2024 and Lower borrowing costs are positive for gold as the metal doesn’t pay interest.

The FOMC expects two rate cuts in 2025, implying a cautious stance toward future monetary easing. Moreover, following two years of tightening, the ECB began to ease monetary policy in 2024, in line with global trends. This change attempts to boost economic growth while inflation falls. The BoE’s November 2024 Monetary Policy Report indicated a shift towards easing, echoing a global trend among central banks to encourage economic growth as inflation pressures fall. Meanwhile, it is projected that the Bank of Japan will hike interest rates twice in 2025.

US FED Funds rate and Gold

2. Political Uncertainty

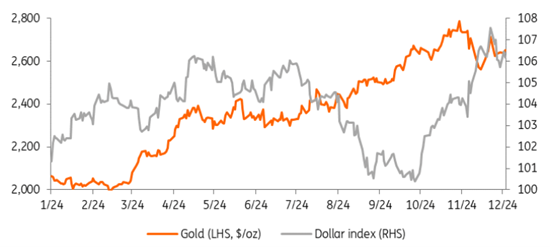

Donald Trump who has won the presidential election in the United States, has proposed policies that could reignite inflation. The findings indicate substantial alterations in policy and economic initiatives, with possible implications for global markets and geopolitics. In less than two months, Trump has issued import duty threats against China, Canada, Mexico, and all nine BRICS members. In doing so, Trump is reigniting fears of global trade wars and causing global economic uncertainty.

The US government continues to run large budget deficits, the US debt is increasing, and interest payments have risen. While recent interest rate cut have eased some of the pressure, there is little sign of a drop in government expenditure, thus the US will most likely have to inflate away the debt, which will benefit gold and silver in the long run.

3. Inflation

Inflation, which has alarmed policymakers and investors in recent years, continues to normalize. However, progress may be gradual, and specifics will differ per country. In the United States, inflation may rise by the end of 2025 due to higher pricing and labour expenses caused by new tariff and immigration policies, before returning to a decreasing trend in 2026 as GDP slows. In both the eurozone and the United Kingdom, inflation is expected to fall steadily despite underlying growth difficulties. All these uncertainties regarding inflation would turn positive for gold and silver.

4. Investment Demand

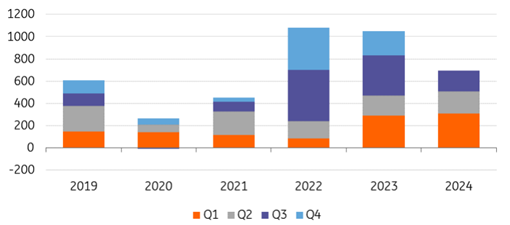

Central banks remained key players in the gold market, boosting global gold holdings by almost 745 tonnes in the first ten months of 2024. The Reserve Bank of India purchased 77 tonnes of gold, representing a fivefold increase over the same period in 2023. Gold currently accounts for 10.2% of the RBI’s currency reserves, up from 7.8% a year earlier. This makes the RBI one of the top gold buyers among central banks in 2024. The Turkish Central Bank bought 72 tonnes of gold, followed by the Polish Central Bank’s acquisition of 69 tonnes.. This underlines gold’s significance as a strategic asset for central banks in risk management and reserve diversification.

Quarterwise Central Bank Gold buying (in tonnes)

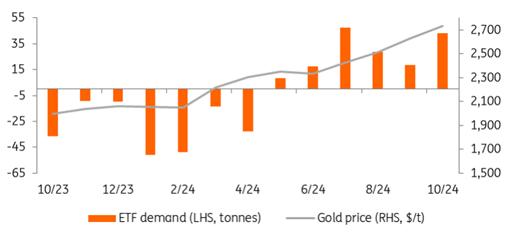

Furthermore, globally gold ETFs had inflows for the past six months consecutively, led by North American and Asian countries. Investors frequently increase their holdings of gold ETFs when gold prices rise, and vice versa. However, gold ETF holdings have fallen during 2024 as spot gold prices have reached new highs. ETF flows finally turned positive in May.

Monthwise ETF Inflows (in tonnes) vs Gold

Major central banks are anticipated to continue buying gold, albeit in smaller quantities than last year. ETF investors returned to gold in the second half of 2024, following a prolonged sell-off. If the Chinese government’s economic stimulus efforts succeed, China and India might provide a firm foundation for gold demand in 2025.

5. Geopolitical Uncertainty

Geopolitical risks such as the conflict in Ukraine and the situation in the Middle East persist. There are rising hazards, such as concerns about European sovereign debt and geopolitical unrest in countries such as South Korea and Syria. Gold has generally been viewed as a safe-haven during difficult times. This global economic uncertainty, combined with the expected increase in inflation caused by potential trade wars, will have serious consequences for global financial markets, but it will most likely benefit precious metals prices, given gold’s role as universal safe-haven assets and traditional inflation hedges. With Donald Trump’s return as US president, there is likely to be greater uncertainty about trade and tariffs, which should strengthen the gold price.

Outlook for 2025

I believe that the precious metal upward trend will continue in the short to medium term. The macroeconomic background will most certainly remain favourable for the precious metal as interest rates fall and foreign-reserve diversification continues amid geopolitical tensions, producing a perfect storm for gold. In the long term, Trump’s proposed policies, which include inflationary tariffs and stronger immigration controls, will constrain the Federal Reserve’s ability to decrease interest rates. A higher USD and tighter monetary policy may eventually present some headwinds for gold. Increased trade friction, on the other hand, may strengthen gold’s appeal as a safe-haven.

With the continued geopolitical, political and macro uncertainty, gold and silver are expected to retain their appeal as a hedge against inflation. Investors may adopt a “buy on dips” strategy as the metal is anticipated to experience periodic oscillations, but the long-term view remains favourable for the next 5-6 months and prices are expected to touch $3000 (~Rs 85000) for gold and $38 (~Rs 115,000) for Silver.

On the downside, $2500 (~Rs 73000) is expected to be a strong support for Gold and $28 (~Rs 85000) for Silver. Therefore 12% upside is expected in Gold and a 25% upside in Silver with a very limited 3-4% downside from current levels. One should at least allocate 10% of the investment portfolio to Gold and 10% to Silver for 2025 for better risk-adjusted returns.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice