Fundamental News and Triggers

- This week saw a new all-time high for gold, but it didn’t take long for it to start declining again; it’s presently headed for its worst weekly decline since the end of last year. Due to persistent inflation data, reduced interest cuts are not only not expected in the US currently, but they are also expected to occur later in 2024, which has led to enormous increases in gold.

- The US Federal Reserve’s dwindling odds of cutting interest rates in September put some selling pressure on the precious metal. Waller, the Fed, is scheduled to speak today.

- The Fed officials’ hawkish comments might put more pressure on the yellow metal. It is important to remember that higher rates often lower gold prices since they raise the opportunity cost of investment.

Technical Triggers

- As suggested, Gold has double topped and is expected to retrace to $2345-50 (Rs 72000), the same thing happened. Now this retracement is expected to continue towards $2300 (Rs 70500).

- As suggested in yesterday’s report, if silver prices retrace below $31 (Rs 92000), it means it has topped out and we can see a correction towards Rs 90000 and Rs 87500. Prices ran up very fast and were trading in the overbought territory this week, so this retracement was due for the healthy bull market.

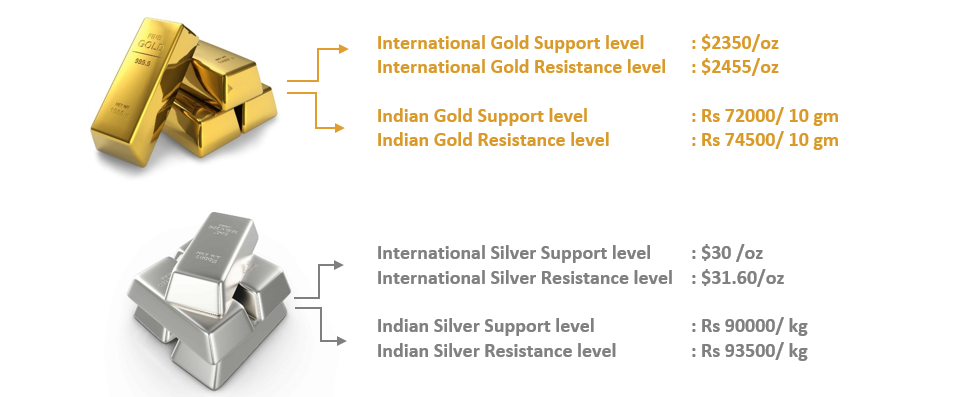

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.