Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – Gold and Silver will continue to consolidate at downtrend channel, until a positive news. Long-term View (3-4months) – Positive – – Any dips towards 49000 and 52000 should be used as buying opportunities for the target of 52000 and 60000 for Gold and Silver respectively in long-term.

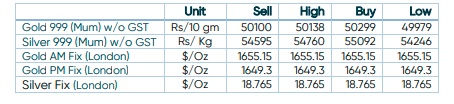

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Gold broke below key $1650 support before bulls in the space lucked out. FED has raised interest rates by 300 basis points since March to curb runaway price pressures and is likely to add another 125 basis points before the year-end. Economists expect further hikes in 2023, making any talk of “peakinflation” irrelevant for now.

- Economic Data – A 75 bps rate hike by the Fed looks real as the odds have reached almost 100%. Soaring odds for hawkish Fed have pushed 10-year yields above 4% confidently.

- Interest Rate – Physical gold buying improved in India this week as prices cooled ahead of the Dhanteras and Diwali festivals later this month, while Chinese premiums stayed elevated amid robust demand.

Disclaimer