Fundamental News and Triggers

- It appears that gold is moving in anticipation of the possibility of lower rates at some time. More significantly, gold is a great asset to have in case the Federal Reserve makes a move contrary to what it usually does after a rate increase cycle.

- Traders and investors received yet another dose of warmer PPI inflation data yesterday, following the unexpectedly warm U.S. CPI report for February on Tuesday.

- While the Federal Reserve is concerned about rising inflation, the most recent economic data is not having a significant effect on forecasts for interest rates. The likelihood of a rate decrease in June is still over 60%, according to the markets, and this will continue to support higher gold prices.

Technical Triggers

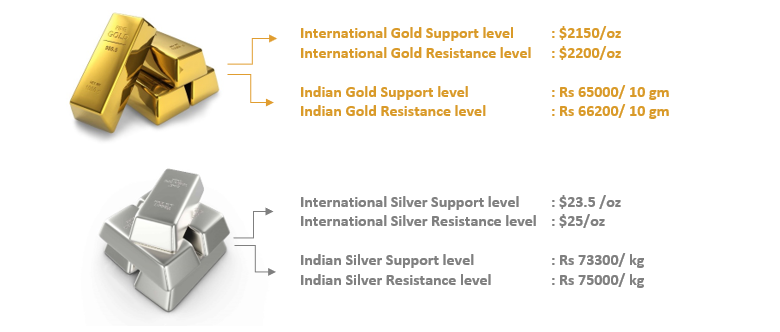

- As stated before, gold has touched the target of $2200. Now we could see some profit-booking and retracement towards $2150 (~Rs 65000) before the prices could see another runup.

- Silver prices almost touched the target of $25 (~Rs 75000), as stated before. Now prices are seeing profit-booking and retracement towards $24 (~Rs 72500).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.