Fundamental News and Triggers

- Gold was on track for a third straight week of gains today, following three consecutive record highs this week, fueled by the Federal Reserve’s rate drop forecasts for the year and safe-haven demand amid geopolitical and economic uncertainty.

- President Donald Trump’s initial initiatives, which included extensive import tariffs, appear to have pushed the US economy toward slower growth and, at least temporarily, higher inflation.

- Meanwhile, geopolitical tensions remain persistent as 91 Palestinians were killed in bombings across Gaza on Thursday, when Israel restarted bombing and military operations, effectively breaking a two-month-old ceasefire.

Technical Triggers

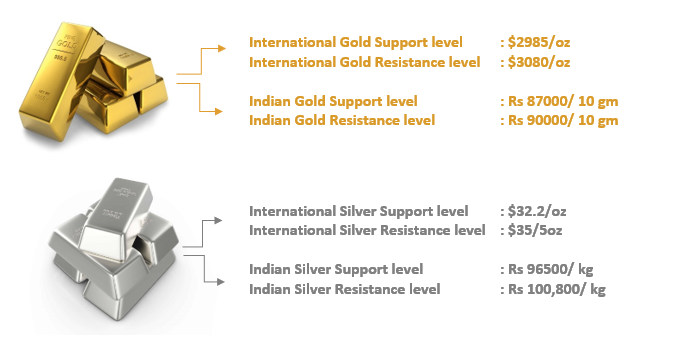

- If Gold Apr Futures fall below $3030 (~Rs 88200), we could see further retracement and profit-booking in prices up to $2985 (~Rs 87000).

- While Silver after achieving the target of $35 (~Rs 102,000) is retracing back. If prices sustain below $33.65 (~Rs 98500), more weakness could be observed.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.