Fundamental News and Triggers

- Gold surges beyond $2300 (~Rs 69400), propelled by robust US data and concerns in the Middle East. Gold’s latest surge was supported by Israel’s attack on the Iranian embassy in Syria on April 1, even though this week saw a spike in US rates and a strengthening US dollar.

- A tight job market, high US Treasury rates, and a strong US dollar offset geopolitical concerns.

- According to the CME FedWatch Tool, traders presently give the possibility of the US central bank lowering borrowing prices a 58% chance of happening in terms of future interest rate changes by the Federal Reserve.

Technical Triggers

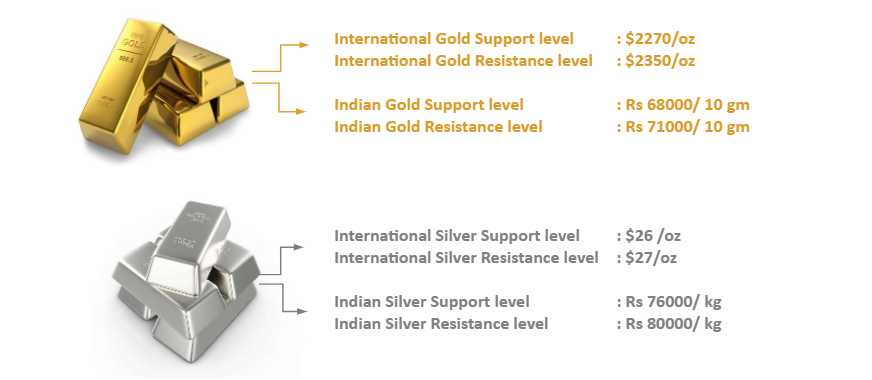

- Gold has moved to unchartered territory with prices seeing hyperbolic move above $2300 (~ Rs 69400). If this momentum continues, the next resistance level is $2350 (~Rs 71000). But as oscillators are in an overbought zone, one needs to be very cautious.

- Silver prices have finally given a break out of its range at $26 (~Rs 77000). Next resistance to watch for is $27 (~Rs 80000), if that is also sustained, then no one can stop Silver from moving towards the $30 (~Rs 90000) target in 2024.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.