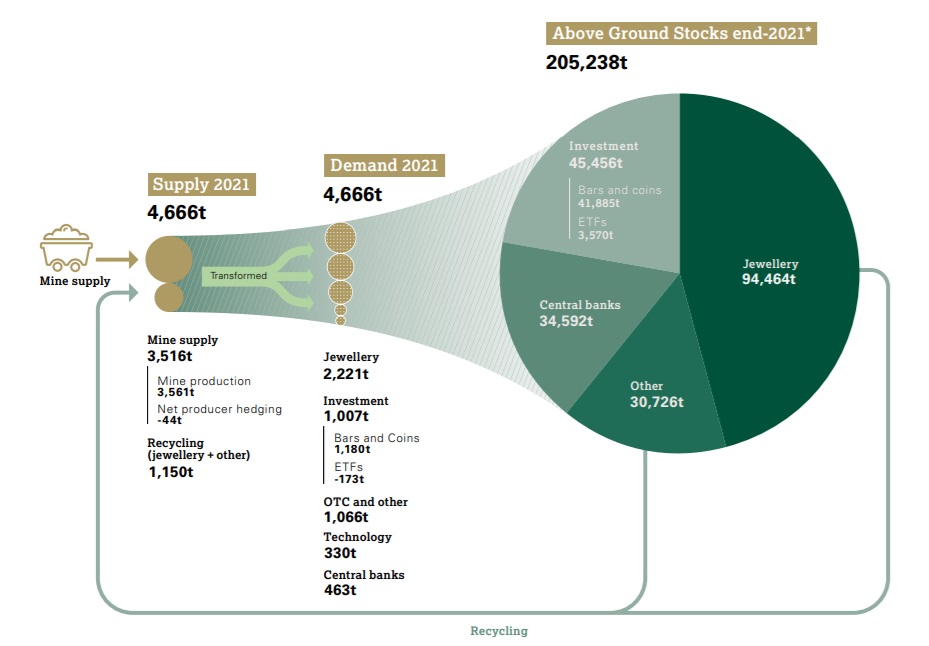

- Total gold supply eased marginally in 2021: down 1% at 4,666t, its lowest level since 2017. Mine production recovered 2% over the year but this growth was counteracted by a sharp 11% drop in recycling.

- On Gold demand, Jewellery fabrication staged a strong recovery in 2021. It grew 67% to 2,221t to meet the strong rebound in jewellery consumer demand, which increased 52% in 2021 to 2,124t, matching the 2019 total.

- Annual jewellery consumption rebounded to pre-pandemic levels, boosted by Q4 sprint finish. 2021 was a redemption story for global jewellery demand as it recovered fully from the blows inflicted by COVID in 2020.

- Global holdings of gold ETFs fell by 173t in 2021 in sharp contrast to 2020’s record 874t increase.

- Bar and coin investment maintained its momentum, jumping 31% to an eight-year high of 1,180t.

- Central banks accumulated 463t of gold in 2021, 82% higher than the 2020 total and lifting global reserves to a near 30-year high.

- Gold used in technology grew 9% in 2021, to reach a three-year high of 330t.

Source: World Gold Council

Gold drew direction chiefly from inflation and interest rate expectations in 2021. Investment may struggle in 2022 amid competing forces but consumer demand should hold strong and central banks will likely keep buying.

Looking ahead in 2022:

- Investment may face challenges from rising rates and the recent strong increase in bar and coin demand may be an additional headwind to further growth, but persistently high inflation and equity market pullbacks will likely be supportive

- Consumer-driven demand should benefit from a weaker price environment with good underlying economic growth

- Central banks are expected to continue buying gold but at a slower pace than in 2021

- Expected growth in mine supply, due to fewer COVID disruptions and ramp ups/first pours at various mines, is likely to be offset by a fall in recycling, which would leave total gold supply largely unchanged.

1 Comment. Leave new

Rexj