Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – –Gold and Silver prices have been continuously falling from past few days but market is oversold zone now Long-term View (3-4months) –Any dips towards 50000-51000 and 62000-63000 should be used as buying opportunities for the target of 55000 and 75000 for Gold and Silver respectively

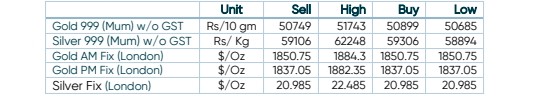

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – Bullion has dropped 10% from a March peak as faster cost pressures fueled expectations that the Federal Reserve will aggressively tighten policy. A rally in the dollar to the highest in two years is also weighing on the precious metal.

- Demand and supply – In the last three weeks the SPDR Gold Trust has seen outflows equivalent to more than 38 tons of bullion, the biggest drop in over a year.

- Economic Data – United States reported inflation ran at an 8.3% pace in April, lower than March’s 8.6% rate but above expectations for an 8.1% rise.

- Domestic News– Strong demand in India due to marriage season, for Gold as prices have retraced.

Disclaimer