Gold rebounds above $1800 from a five-month low as US yields tumble. US yields spiked to the downside. The US 10-year dropped to as low as 2.79%, the lowest since late while the 30-year tumbled to 3.02%. Recession fears are softening Fed’s tightening expectations. Meanwhile, an increase in import duty in India, the world’s No. 2 consumer, compounded concerns about higher interest rates.

Why was import duty raised suddenly?

Following a spike in exports, the Finance Ministry increased the import tariff on gold from 10.75 percent to 15 percent. The rising import bill in India puts pressure on the country’s current account imbalance.

A widening trade deficit has pushed the euro to an all-time low. This week, the USDINR hit a new low of 70/$ due to rising inflation and widening trade imbalances. The hike in gold import duties is intended to curb gold imports and relieve macroeconomic pressure on the currency.

The government’s action is intended to compensate for lower income from petroleum taxes while also discouraging gold imports, which raise US dollar demand and hence weaken the Indian rupee. India buys a lot of crude oil and gold, which depletes its foreign reserves, and the government is trying to get people to invest in gold bonds and ETFs instead of physical gold.

Essentially, India’s gold purchases have increased in the last year following a decline during the pandemic, and the country bought the most gold in a decade in 2021. Imports of gold have surged unexpectedly. In May, 107 tonnes of gold were imported, and the figure was similar in June. India’s May trade imbalance increased to $24.29 billion from $6.53 billion a year before, while gold imports increased to $6 billion from $678 million. The rise in gold import charge aims to curb gold imports and relieve macroeconomic pressure on the Indian rupee.

Effective Import duty hike

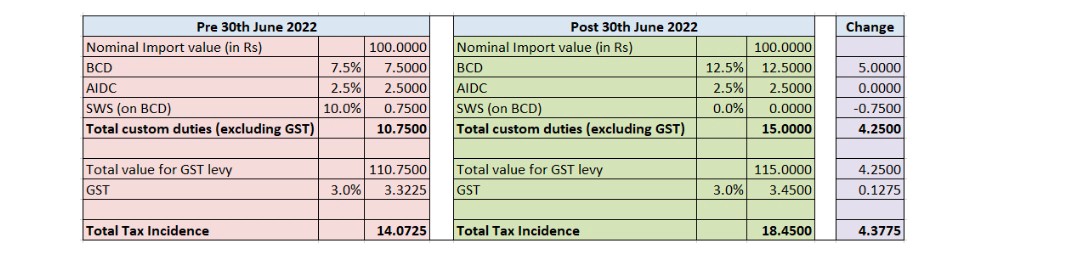

Earlier, the basic customs duty on gold was 7.5%, now it will be 12.5%. Along with the agriculture infrastructure development cess (AIDC) of 2.5 per cent, the effective gold customs duty will be 15%

Note: BCD = Basic Custom Duty; AIDC = Agriculture Infrastructure and Development Cess; SWS= Social Welfare Surcharge; GST= Goods and Service Tax

Impact of duty hike in India

The tariff increase should raise prices and decrease demand in India, potentially weighing on worldwide pricing. However, it may increase under-the-counter purchases and precious metal smuggling into the country. Following the tariff increase, dealers were providing discounts of up to $40/oz off official domestic prices.

Those who are buying gold for investment purpose, should start choosing digital means such as Digital Gold, Gold ETF and Sovereign Gold bond. And who want to use gold should opt for jewellery. This will reduce Gold Imports and impact on Current Account Deficit going forward. And if CAD remains stable for several months, govt will reduce import duties.