Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold has broken the symmetrical triangle range to upside while Silver has broken it to downside. But is oversold, so recovery expected.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

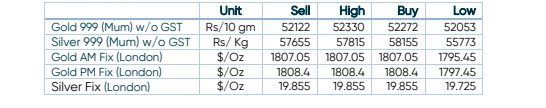

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

Gold holds $1800, as the spotlight shifts to FED minutes

- International News – Gold is supported around $1800, having dropped over $40 in the past month, given the ongoing jitters with market confidence amid fears of a recession as well as a war in Ukraine.

- Demand and Supply – G7 countries, UK, Australia have signaled the ban of Russian gold, which produces around 300 tonnes

- Economic Data– This week, Fed minutes and the US NFP will keep investors busy.

- Domestic News– Custom Department has notified on 30 June that Import Duty on Gold is increased from 7.5% to 12.5%. Additional to that there would be 2.5% Agricultural Cess and 3% GST, therefore effective import duty would be 18%.