By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold prices have fallen from recent record highs, as increasing yields and a stronger currency point to a less aggressive rate decrease by the Federal Reserve. This adjustment comes despite a string of economic indications pointing to a less aggressive rate decrease by the Fed next month.

Powell stated at Jackson Hole that the “time has come for policy to adjust” and that the timing of rate decreases “will depend on incoming data”. He also emphasized the employment market, stating that they would “not seek or welcome further cooling in labour market conditions.”

The US financial markets will be closed on Monday to observe the Labor Day vacation. The August ISM PMI will be released on Tuesday in the United States. Investors predict the headline PMI to rise to 47.8 from 46.8 in July. A rating over 50, indicating that economic activity in the manufacturing sector has returned to growth territory, might support the USD with an instant reaction while weighing on gold.

Next week’s jobs report will shape expectations for the September rate decision. Federal Reserve officials will examine August hiring numbers for signs of labour market contraction, with a focus on the latest unemployment figures. If the unemployment rate worsens, the Fed may cut rates more aggressively to cushion the economy from potential repercussions.

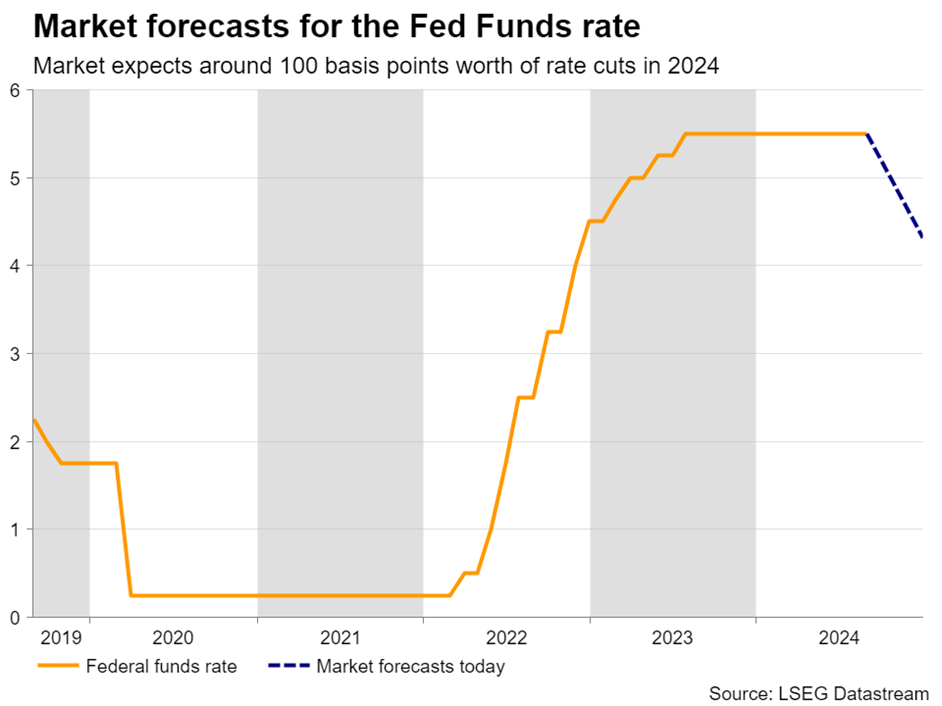

According to the CME Fed Watch Tool, markets currently expect the Fed to lower its policy rate by at least 100 basis points by the end of the year. A second consecutive weak NFP print could lead to lower US Treasury bond yields and the USD, allowing Gold to rise to $2600 (~Rs 75000).

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.