Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold has finally broken the downtrend channel on upside and if prices sustain above 51400, it could head higher towards 53000.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

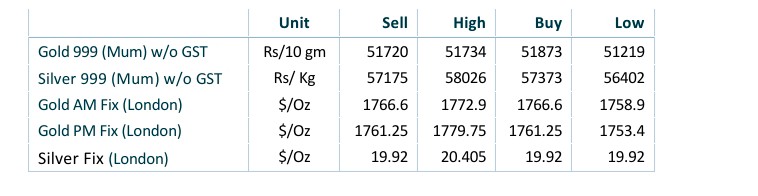

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Gold marches towards Rs 51500 hurdle with eyes on Taiwan, NFP

- International News – A lack of support for the US-Taiwan ties also seems to help the gold buyers. The reason could be linked to the Democratic Party members’ ability to stop the US policymakers from mingling more with Taiwan which China doesn’t like, the same could help the market sentiment and the gold.

- Economic Data – The July FOMC meeting gave way to a sharp pullback in Treasury yields, with the 2-year yield dropping to its lowest level in nearly a month (2.84%) as comments made by Chair Powell were taken as a signal that peak Fed hawkishness has passed.

- Domestic News – The India International Bullion Exchange which has enrolled over 60 qualified jewellers to trade on the exchange and set up infrastructure to store physical gold and silver was launched last weekend.