Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – – Silver prices have sustained a breakout above its downtrend channel after six months. Bull run has started.

Long-term View (3-4months) – Positive – – – – Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

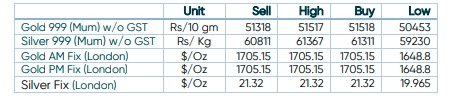

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – – Gold has traded up almost 100$ from the post-FOMC low at $1615, now a potential triple bottom, while silver has returned to challenging the 200-day moving average at $21.50 for the first time since the April slump.

- Economic Data – – The market will turn its attention to today’s US October CPI print for additional guidance with forecasts pointing to easing price pressures. If Inflation comes lower, it may support bullion through a weaker dollar as the FOMC would be more inclined to slow its pace of rate hikes. On the other hand, a stronger than expected number may trigger a kneejerk downside reaction before recovering as investors and traders begin to wonder, whether the FOMC will be successful in bringing inflation under control in time to avoid a major economic downturn.

Disclaimer

1 Comment. Leave new

Your article helped me a lot, is there any more related content? Thanks!