Fundamental News and Triggers

- A variety of divergent influences is affecting the gold price, which fluctuates within a range. USD bullishness caps the upside, but hawkish Fed predictions drove up US bond rates and inturn supporting the prices. Ahead of the crucial FOMC meeting tomorrow, geopolitical concerns provide some backing to the gold.

- It is anticipated by the market that the Fed will begin lowering key borrowing rates at its policy meeting in June. The PPI and CPI were surprisingly rigid in February, though, thus the likelihood of the rate cut in June has decreased dramatically. Before the inflation data was released, the probability of a rate decrease was 72%; however, according to the CME FedWatch tool, it is now just 57%.

Technical Triggers

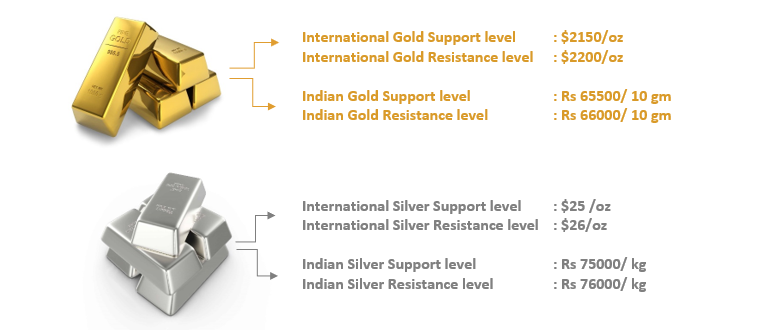

- After touching record-high prices of $2200, gold is taking a breath and consolidating around high levels, before starting a new runup.

- Silver prices are facing a resistance zone around $25.50-$26 (~Rs 76000 – Rs 77000), prices need to sustain above this level to head higher.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.