Fundamental News and Triggers

- Gold prices are reaching unprecedented levels in 2025, and recent back-to-back advances indicate that another parabolic price movement may be on the horizon.

- The safe-haven commodity appears to be impacted by the optimism surrounding US-China trade negotiations. On Tuesday, US President Donald Trump announced that he and senior government officials will spend the next two weeks evaluating possible trade agreements to determine which ones to approve. Trump previously said that his administration may announce trade agreements with some nations as early as this week, but this contradicts that claim.

- Gold’s recent gains can be attributed to two main factors: extreme market optimism and notable dollar weakening. Gold is becoming a more popular safe-haven commodity among investors as geopolitical and economic instability around the world increases.

- Genuine worries that these taxes would lead to higher inflation are fueled by recent economic data that show slowdowns in the US, China, the EU, and many other nations.

Technical Triggers

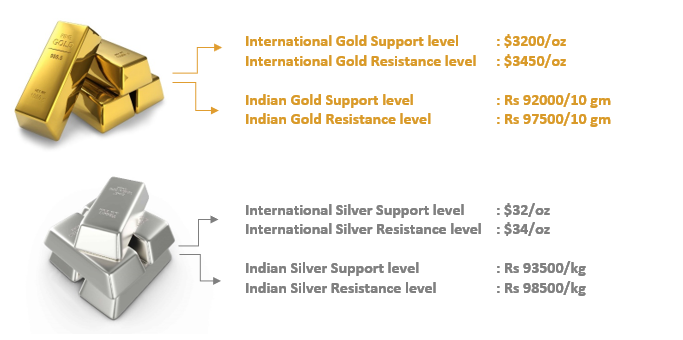

- Gold prices have given a breakout above $3380 (~Rs 96000), it seems this rally will continue towards $3450 (~Rs 97500) again.

- Silver prices are expected to consolidate between $32 (~Rs 93500) and $34(~Rs 98500).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.