Gold prices have fallen to a two-month low as investors become weary of the Fed’s conflicting signals on policy normalisation and wait for further information to assess the Fed’s stance moving ahead. Furthermore, after the Fed’s hawkish stance earlier in June month, the dollar index has made a solid rebound, putting downward pressure on gold prices.

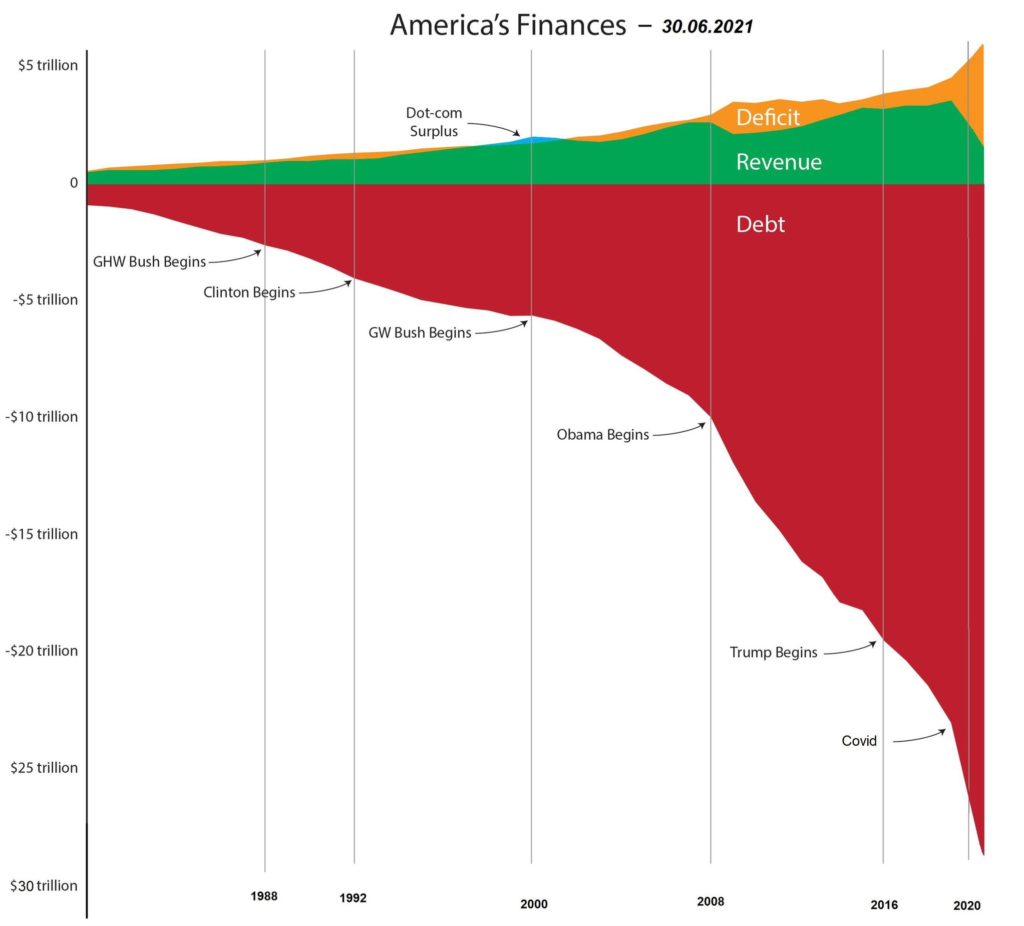

The dollar’s current strength is also anticipated to take a breather as progress on US Vice President Joe Biden’s ambitious $1.2 trillion infrastructure programme is made, which could help the precious metal recover. The rebound in Dollar Index seems to be temporary as US Debt is seeing steep rise as US stimulus was announced last year. Government revenues are continuously falling from the past few years and deficit is continuously rising.

Along with that, market players are keeping a watch on a recent spike in the Delta variant of the COVID-19 virus in Asia and Europe, which might support safe-haven demand for gold following the recent drop.

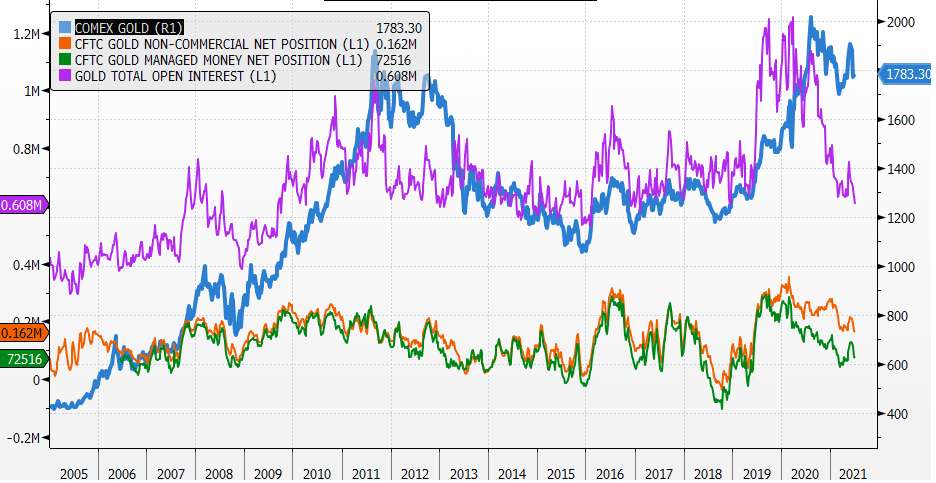

However, looking at the Gold COT report, it specifies that Money Managers and Non-Commercials are reducing net positions from Gold. Total Open Interest is also at 5-year low level, which is a negative signal for Gold prices.

Gold CFTC Open Interest

After a significant drop, gold is stabilizing at the critical support zone of 46,500 to 46,300 per 10 gms and is likely to rebound in the near term, according to the pricing setup. For the month ahead, a climb towards the 47,500 per 10 gm barrier is feasible, with the potential to extend further into the 48100 per 10 gm mark. A prolonged closure below the stated support, on the other hand, may lead to selling pressure, pushing the metal down into the 45,500 to 45,300 per 10 gms zone.

You may also like to read: Gold prices ekes out amid Risk-ON as the Chinese market tremors