Fundamental News and Triggers

- Gold prices rebound due to rising global trade concerns caused by US auto tariffs. US President Donald Trump announced a 25% tariff on imported vehicles and light trucks beginning next week, escalating the global trade war. The deadline for retaliatory duties from the world’s largest economy is April 2.

- Investors are looking forward to Friday’s U.S. personal consumption expenditures data, which may provide insight into the country’s interest rate path.

- According to World Gold Council data, global gold ETFs saw $3 billion in net inflows last week alone, or around 31 tons of gold. That was the seventh straight week of inflows, with North America accounting for the majority of the purchases. Year-to-date, global net inflows have exceeded $19 billion (207 tons), putting 2025 on track for the strongest Q1 since 2022.

Technical Triggers

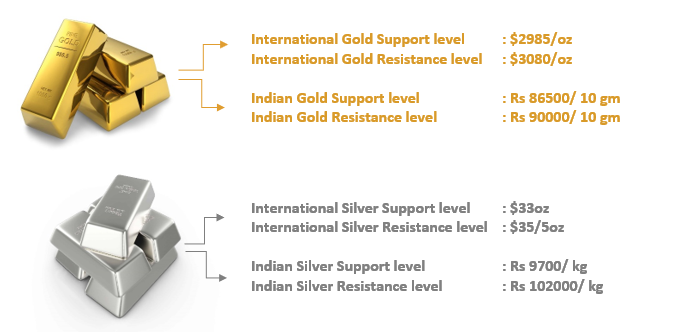

- Gold has strong support at $3010 (~Rs 87200), if prices fall below this level, we could see further retracement and profit-booking in prices up to $2985 (~Rs 86500). While if prices sustain above $3040 ( ~Rs 88200), they can again head higher towards $3080(~Rs 90000)

- Silver is trading in a range of $33 (~Rs 97000) to $35(~Rs 102,000) from the last few days. Buy on dips and sell on rallies should be the strategy used.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.