Fundamental News and Triggers

- Given the ongoing geopolitical concerns, the gold price is expected to stabilize after making significant recent gains that sent it to an all-time high on Monday. The US dollar is supported by high bond rates, which also limit the increase in gold prices.

- The possibility of a new uptick in Middle East geopolitical tensions has increased as a result of Iran’s military threats against Israel following an alleged attack on its embassy in Syria. The safe-haven gold price may thus continue to be supported by this, limiting any potential correction.

- With the yield on the benchmark 10-year US government bond reaching its highest point since late November, the markets are now pricing in a roughly 50% likelihood that the Fed will maintain the policy rate in June.

Technical Triggers

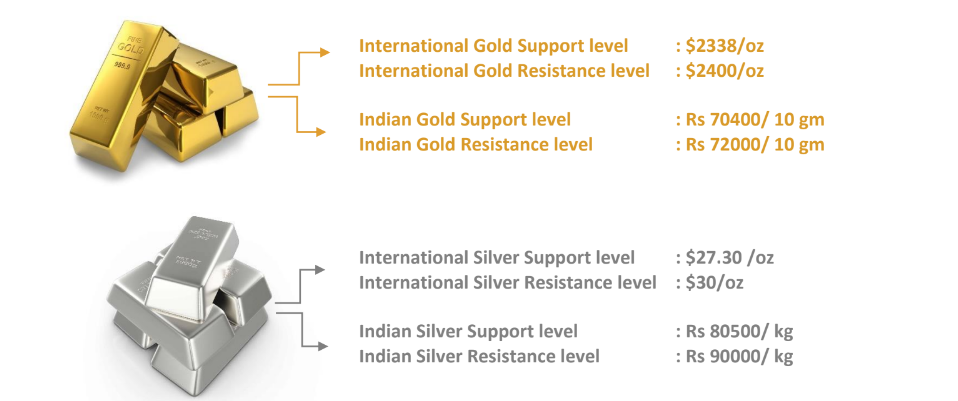

- As forecasted, gold has achieved the short-term target of $2350 (Rs 71000), next target is $2400 (Rs 72500). But as oscillators are in an overbought zone, one needs to be very cautious for price retracement.

- Silver prices have finally given a break out above $27 (~Rs 80000), if that is sustained, then no one can stop Silver from moving towards the $30 (~Rs 90000) targets in April. But as oscillators are in an overbought zone, one needs to be very cautious for price retracement.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.