Fundamental Q News and Triggers

• Gold prices are trading steady, supported by a weaker dollar and Treasury yields after the Federal Reserve struck a less hawkish tone than expected, although gains in gold were limited by increased risk appetite.

• As was generally anticipated, the central bank kept interest rates unchanged on Wednesday. Markets, however, were pricing in a lower likelihood of any additional rate hikes following remarks made by Fed Chair Jerome Powell, who also noted that financial conditions have significantly tightened in recent months.

• Focus was now on upcoming U.S. nonfarm payrolls data, due today. Powell reiterated this idea on Wednesday. The Fed is more inclined to raise rates when there are indications of strength in the

labour market.

Technical Triggers

• Gold prices are consolidating in a range, and if it sustains above 61100, can rise to 61400. While if it

sustains below 60700, can retrace up to levels of Rs 60200, due to the profit-booking of a steep rally.

• Silver prices are also consolidating in a range, and if it sustains above 72000, can rise to 73500. While if it sustains below 70900, can retrace up to Rs 70000 due to profit booking.

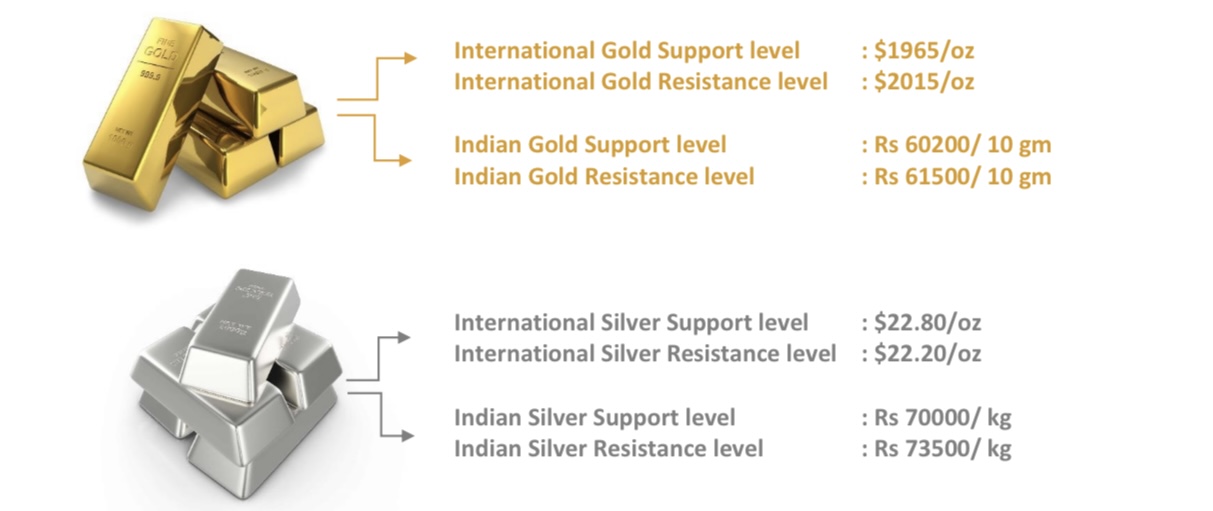

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.