Fundamental News and Triggers

- As tensions between Israel and Hamas continue to rise, the price of gold rises beyond $2380. Following Israeli Prime Minister Benjamin Netanyahu’s announcement on Monday that his forces are prepared to invade the Gaza Strip’s Rafah pocket, there was a significant decrease in speculation on a cease-fire, according to Reuters. Hamas, on the other hand, said that Israel’s ceasefire offering did not meet their conditions. As demand for safe havens rises due to global uncertainties, the precious metal is still fetching high prices.

- Strong demand for safe-haven assets amid escalating global tensions is balancing the negative effects of diminishing expectations that the Federal Reserve would switch to rate reduction in June, which is why the precious metal is still rising.

Technical Triggers

- As forecasted, gold has achieved the short-term target of $2350 (Rs 71000), next target is $2400 (Rs 72500). But as oscillators are in an overbought zone, one needs to be very cautious for price retracement.

- Silver prices have finally given a break out above $27 (~Rs 80000), if that is sustained, then no one can stop Silver from moving towards the $30 (~Rs 90000) targets in April. But as oscillators are in an overbought zone, one needs to be very cautious for price retracement.

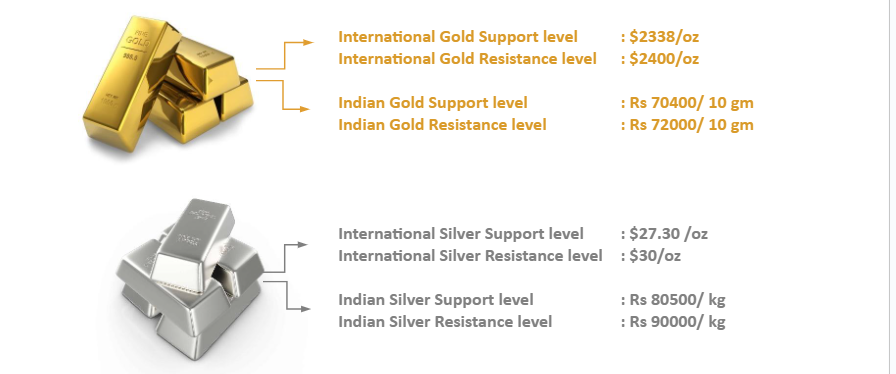

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.