By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold is maintaining strong bullish momentum and prices touched a new record high of $2656 (~Rs 75100) today, driven by a weakening U.S. dollar and the expectation of further rate cuts by the Federal Reserve.

As the Fed eases its monetary policies, lowers interest rates and reduces the opportunity cost of keeping non-yielding assets like gold, making them more tempting to investors. Furthermore, rising geopolitical tensions in the Middle East, particularly between Hezbollah and Israel, are raising demand for safe-haven assets, which is adding to the rise in gold prices. These factors have driven gold to new highs, with more gains expected as investors seek shelter from global instability and accommodating monetary policy.

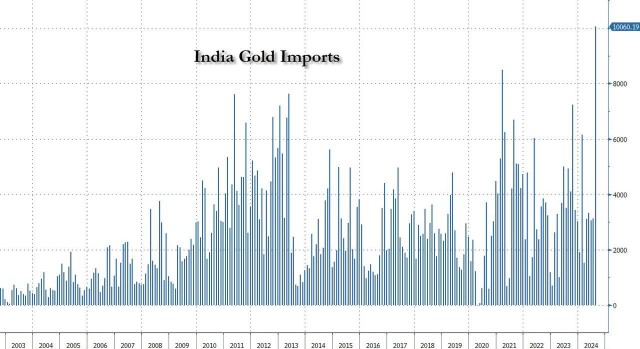

In July, the Indian government reduced taxes on gold and silver imports by more than half, from 15% to 6%. Domestic gold prices declined 6% month on month when the lower charge was implemented, even though gold’s dollar price rose. As predicted, the government’s decision resulted in a significant increase in gold demand. India recorded record gold imports in dollars, totalling $10 billion in August. It was more than a threefold rise from the prior month. According to the World Gold Council, the country imported 140 tons of gold, more than doubling its amount from July. So far in 2024, Indian gold imports are up 30%.

Indian ETFs continue to show gold inflows, indicating significant investor interest in the precious metal. According to World Gold Council estimates, India-based funds saw the largest monthly gold inflows on record in August. So far in 2024, Indian gold ETFs have added around 9.5 tons of gold. The RBI continues to add gold to its reserves. According to the latest numbers, the Indian central bank raised its gold reserves by 50 tons this year. Since 2017, the RBI has begun buying gold. Over that time, it has expanded its gold holdings by more than 260 tons. The Indian Central Bank currently has a record 853.6 tons of gold. The yellow metal accounts for 9 per cent of its foreign reserves, up from 7.5 per cent last year.

Market investors will be watching major economic measures, such as the US Purchasing Managers Index, which might affect the dollar’s strength and gold prices. A stronger-than-expected PMI might boost the USD and put pressure on gold. The forced liquidation of short positions may push gold to new highs, especially if increasing bond rates make other asset classes less attractive. With the Federal Reserve’s cautious stance on future rate decreases and persistent geopolitical uncertainties, gold is poised for more gains. Trading gold amid geopolitical crises can be dangerous owing to the heightened volatility. Traders should focus on purchasing during dips.

Gold Weekly Chart

On the technical front, the precious metal maintains a strong bullish trend on the daily timescale, with the price firmly maintained above the important 100-day exponential moving average. However, the 14-day RSI is above the midline, at 70, suggesting an overbought position. This implies that more consolidation cannot be ruled out before preparing for a near-term gold price increase to $2700. On the other hand, the initial downside objective is $2600. If this level is breached, the price may fall to $2560 (~Rs 73000), which was formerly a resistance level.

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.