By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Last week, both the FOMC and the Bank of England held interest rates steady. Following the FOMC decision, gold and silver dipped due to the FOMC’s hawkish remarks before recovering marginally. Last week, the US Federal Reserve delivered a hawkish pause in its aggressive rate hike campaign, while also expecting significantly higher rates in 2024 and 2025 due to a sturdy US economy, a healthy job market, and sticky inflation. Despite a slew of current headwinds, gold has held up well, with traders and investors looking for a hedge should the Fed fail to offer a soft-landing in the coming months.

There is no doubt that these concerns have contributed to dollar strength in recent months because the dollar represents safety in a world of fiat currencies. These are the kind of doldrums that can sustain a large bull leg, so the risk is being short rather than long. But there is one major obstacle to overcome: a strong Dollar and rising Treasury bond yields.

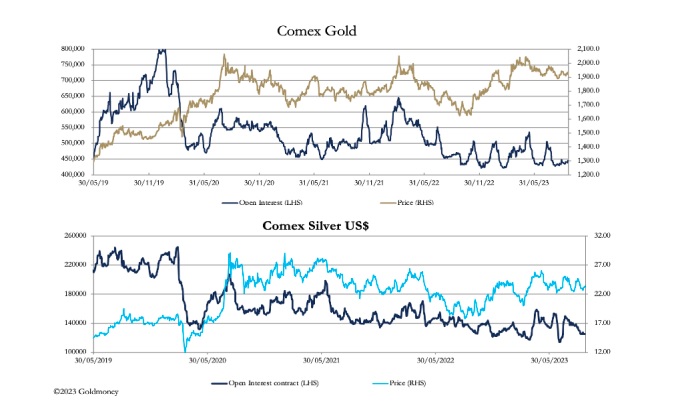

The total holdings of ETFs have decreased by 169 tonnes over the past four months, reaching a 3-1/2-year low of 2761 tonnes, as investors have been reducing their holdings. Just 25k contracts above the lows of March and August, the leverage fund’s net long position was 50k contracts (5 million ounces) in the week ending September 12. The open interest in both gold and silver on the COMEX is still very low, as shown in the below chart, indicating that the potential for further decline is minimal.

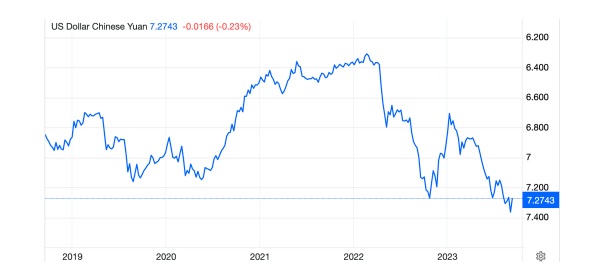

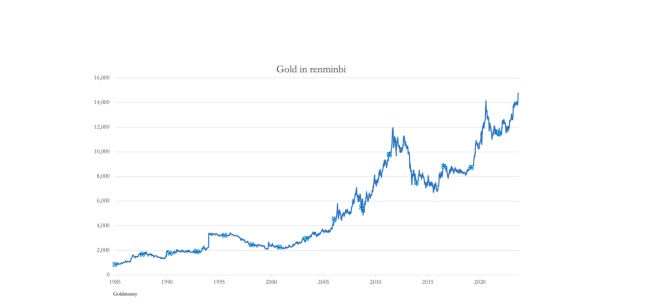

The temporary restrictions on gold imports that the Chinese central bank had placed on select lenders to protect the yuan have now been lifted, which has increased the price of the precious metal in the nation. To slow down a surge in bank purchases of gold abroad as a hedge against a declining home currency, China in August curtailed and eventually ceased allocating quotas for such imports. After the release of unimpressive economic data in early

September, the yuan plunged to its lowest level versus the dollar in 16 years. Despite little price inflation, the yuan has historically been weak, as shown in the figure below.

With the recent dip below the 7.27 level, which was very strong support since October 2022, you can see why the Chinese public would be bearish on the yuan and bullish for gold. Gold in China hit a record Y14,765 yesterday, because of Yuan depreciation.

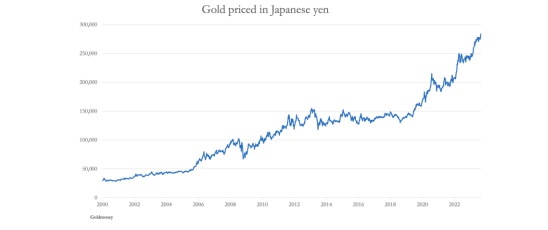

The other story gaining traction is the gold price in the Japanese yen, which is also hitting new

records due to the weakness of the currency.

The price of gold responded to negative developments in the market with a comparatively minor adjustment, which kept it trapped in a constricting range and currently providing support near $1900. The demand for gold as a hedge against a soft-landing disaster won’t likely decrease as the future picture for the US economy becomes more uncertain. In light of this, I continue to have a patiently positive outlook on both gold and silver. As we wait for the FOMC to shift its emphasis from rate hikes to cuts, the timing for a new push to the upside will, however, be highly dependent on US economic data. During this time, as we saw during the previous quarter, we are likely to see prolonged turbulent trade action. For 15-20 days, prices are expected to be rangebound between Rs 58000- 60000/10 gm.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based

on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in

trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance.

Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice