-

Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Negative– Gold and Silver prices are continuously getting support on uptrend line. Next target for Gold and Silver is Rs 60000 and Rs 70000.

Long-term View (3-4months) – Positive – – Gold has made Inverse Head and Shoulder pattern on daily charts. Neckline resistance is $1820. If prices sustain above it, target would be $2020.

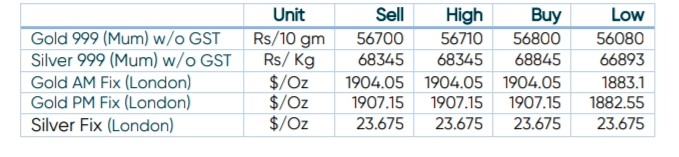

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

Gold trades record high in India on softening inflation

- International News – Gold trades at a record high in Indian markets on cooling inflation. The major supportive factor for gold’s rise was the US CPI print that came in as per the expectation. As per the report, US CPI rose 6.5% in December as compared to 7.1% in Nov (Y-o-Y). The print was the lowest since Oct 2021. Slowing inflation means less aggressive interest rate hikes by Fed. A per the CME Fed watch tool the probability of a 25-bps hike in Feb FOMC meeting has gone up to 92.7%.

- Growth – World Bank economic forecasts add strength to the gold price even if US Dollar probes buyers. World Bank stated that it expects the global economy to grow by 1.7% in 2023, down sharply from 3% in June’s forecast.