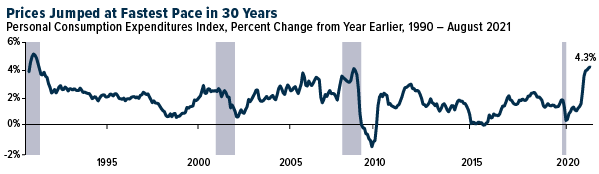

Following the release of economic statistics showing the largest increase in consumer prices in 30 years, gold traded higher last week. In August, the personal consumption expenditure (PCE) index, which measures changes in the prices of goods and services purchased by US consumers, increased by 4.3 percent year over year, marking the ninth month of rising inflation and 30 year high level. By the way, the PCE is the Federal Reserve’s chosen inflation indicator.

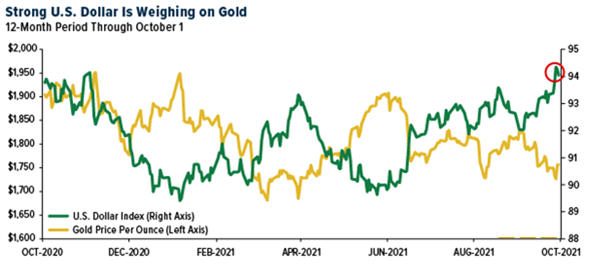

Last week the US Dollar advanced against a basket of foreign currencies to hit its highest level in about a year. For consumers and importers, this is good news, as it means the greenback offers greater purchasing power. On the other hand, this is a headwind for exporters, as well as the price of gold and other commodities priced in US Dollars.

The inverse link between gold and the dollar may be seen in the graphic below. When the dollar strengthens, gold falls; when the dollar weakens, gold rises. This link is crucial for investors to understand since it can help them moderate their expectations.

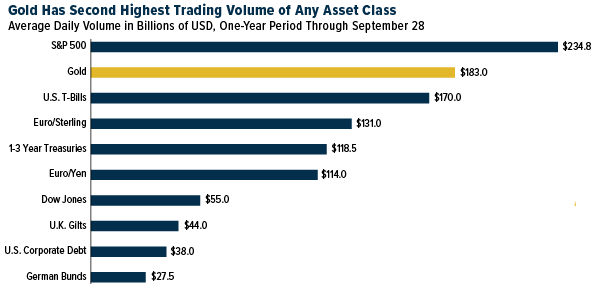

In case investors were wondering if Bitcoin was stealing some of gold’s thunder as a store of value, it’s also crucial to remember that gold remains one of the most heavily traded assets on the planet. The WGC calculates gold liquidity using data from global commodities exchanges, over-the-counter (OTC) markets, and gold-backed exchange-traded funds (ETFs).

Given that Gold has finally rebounded from lows and there is good festive demand supporting prices, we expect gold prices should stay supported higher next week.

Know more: Precious Metals Heads for Second Weekly Gain as Inflation Concerns Persist