A dollar today will not buy the same value of items in 10 years. Inflation is to blame. Inflation refers to price rises over a set period of time and is defined as the average price level of a basket of goods and services in an economy. As a result of inflation, a given quantity of money will be worth less than it was previously.

Inflation in the United States is still a hot topic, thanks to the Federal Reserve’s policy of keeping the financial system awash in cash. The Federal Reserve has maintained interest rates low and purchased Treasuries since last year in an effort to revive the COVID-affected economy and keep financial markets afloat.

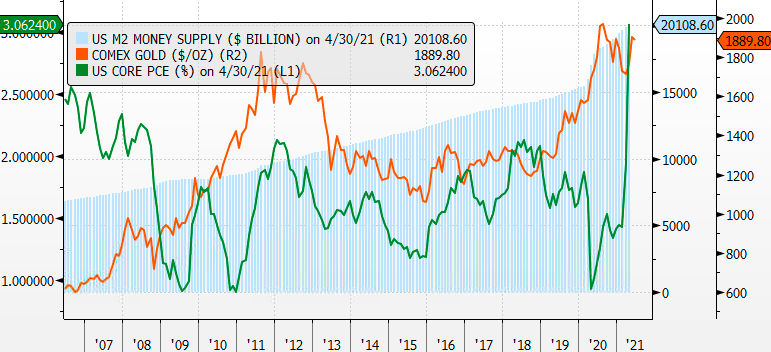

Prices are rising in the United States, according to recent inflation figures, with the Core Personal Consumption Expenditure (PCE) Index increasing beyond 3% in May (30 years high). Officials at the central bank consider it to be the most accurate indicator of inflation. Because of the enormous increase in the US Money Supply, inflation is returning. When the Money Supply has increased in the past, it has been followed by greater inflation – usually five to six months later.

The letter “M” stands for various distinct methods economists calculate the quantity of the US money supply, such as M0, M1, and M2. Cash, checking deposits, savings deposits, and money market securities are all included in the wide M2 metric. Economists and investors consider changes in the M2 supply as an indication of the total money supply and future inflation because of its broad definition.

US Money Supply and Inflation with Gold price

According to empirical research conducted by the World Gold Council, the Gold price has a positive correlation with the money supply increase, a fact that is especially relevant in today’s environment of rapid money supply increase. Furthermore, money supply expansion tends to occur 6 to 9 months before gold price increases. Given the correlations observed with increases in the gold price, the findings of the paper, “Linking Global Money Supply to Gold and Gold to Future Inflation”, suggest that investors may be justified in their concerns that quantitative easing measures will lead to an increase in the velocity of money and inflation and in turn Gold prices.