After starting 2021 on solid footing, gold prices sank to a year-to-date low of Rs 44000 in March before rising to an annual high of Rs 49000 in May. For the rest of the year, gold traded in a tight band between Rs 45500 and Rs 48000. While a huge black swan event occurred in 2020, recovery efforts, increasing inflation, and uncertainty should have helped gold in 2021, but they were less helpful than many had predicted at the start of the year.

GOLD MONTHLY RETURNS OF LAST FIVE YEARS

Source: Bloomberg

Source: Bloomberg

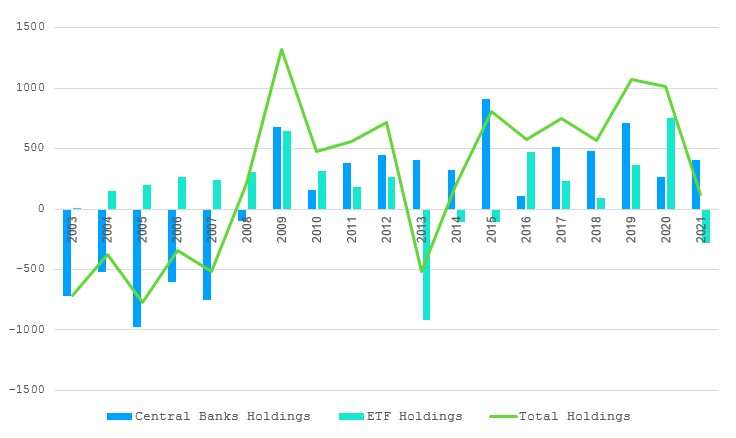

In 2021, increased investor risk appetite led to a 9% drop in gold demand, primarily from the exchange-traded fund (ETF) category. Over the first three quarters, a doubling of central bank buying and a 50% increase in jewellery demand only partially offset the fall in ETF demand. Investment in exchange-traded funds (ETFs) has seen net selling for the first time since 2015. Except for some minor inflows in the second quarter, the first quarter saw net outflows of 200 tonnes, 58 tonnes in the third quarter, and another 28 tonnes in the fourth quarter, bringing the total net outflows for the year to almost 280 tonnes. While I expect central bank and commercial physical buying to buffer any price declines, these flows tend to be counter-cyclical to price performance, with investment flows being the primary driver.

CHANGES IN GLOBAL GOLD HOLDINGS (IN TONNES)

Source: World Gold Council

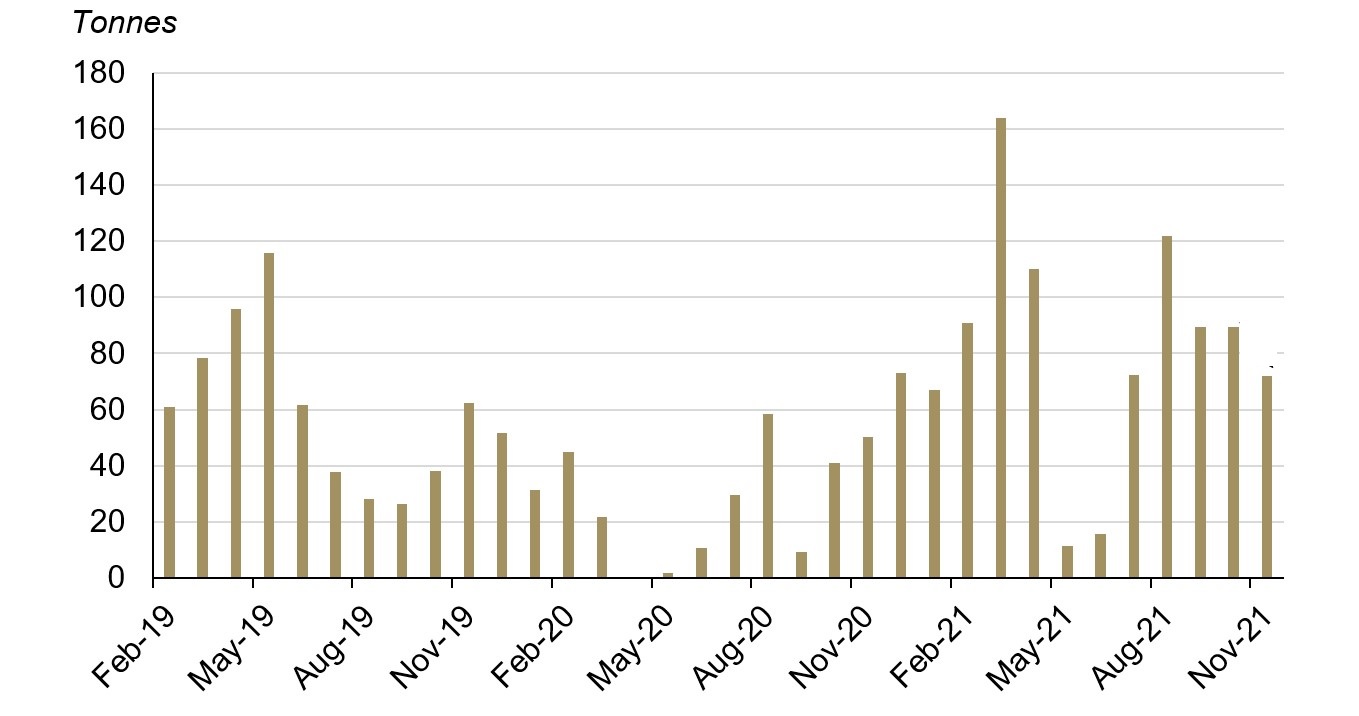

Though the Investment demand picture is not rosy internationally, Gold Investment and Jewellery demand have been fantastic in India. Indian gold ETFs continued to attract inflows, driven by seasonal demand surrounding the Diwali festival and concerns elevated equities. Total ETF Holdings rose by almost 10 tonnes in 2021 to end at around 37 tonnes. Indian Gold imports are also very strong and are expected to cross the 900 tonnes mark in 2021 driven by pent up demand, relaxed restrictions, the highest number of marriages, etc.

INDIA MONTHLY GOLD IMPORTS

Source: Infodrive India, Ministry of Commerce and Industry, World Gold Council

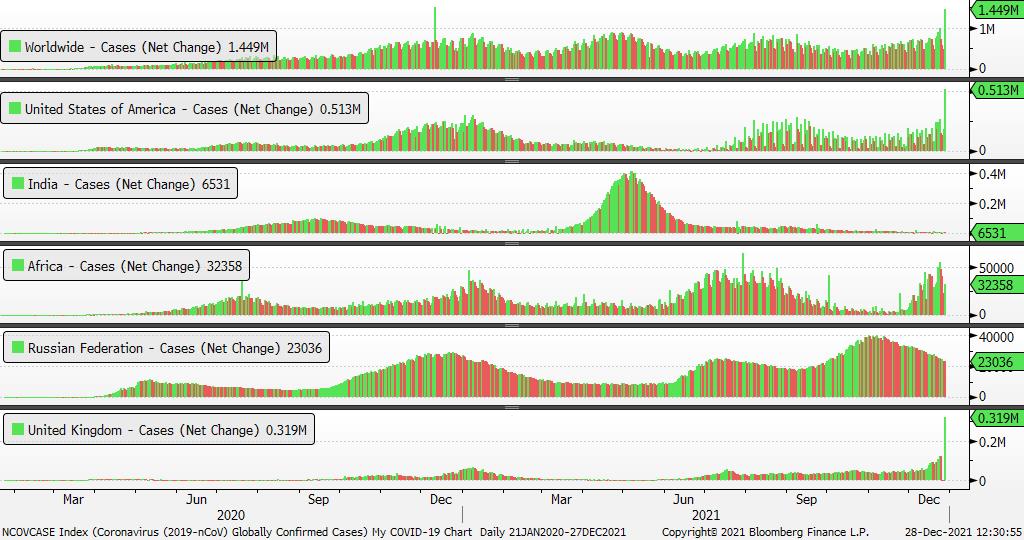

Though the restrictions have been relaxed around the world, international travel is reopened, curfews have been removed in 2021, COVID is also an ever-present source of uncertainty. Many parts of Europe have seen higher cases leading to restrictions being re-imposed. UK records more than 1 lakh COVID cases in a day now. In the US, Omicron is now the dominant strain, accounting for about 73 per cent of the cases over the second week of December.

UK, US, Africa, Russia, etc – all countries are having the highest number of active Coronavirus cases during Christmas 2021. And worldwide summation also tells the same story that a record number of around 10 lakh Coronavirus cases are active at the end of 2021. India in contrast has been registering record-low cases over the past few weeks. We should all understand that we’re not going back to lockdowns this time. We’re going forward to live with this virus with common sense and responsibility.

ACTIVE COVID CASES

Source: Bloomberg

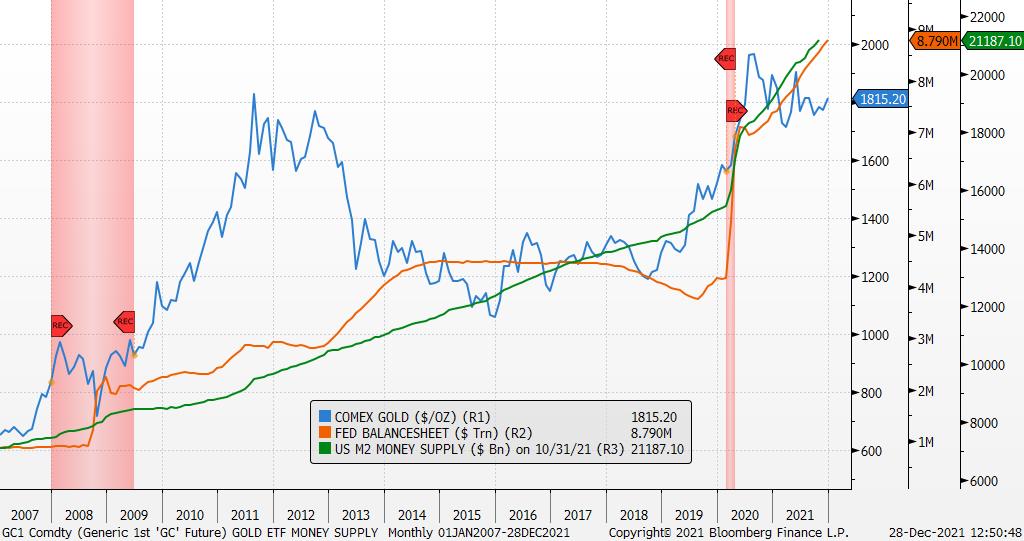

The Federal Reserve’s balance sheet ballooned following their March 15, 2020 announcement to carry out quantitative easing to increase the liquidity of U.S. banks. It reached $ 8.75 trillion in 2021. This measure was taken to increase the money supply and stimulate economic growth in the wake of the damage caused by the COVID-19 pandemic. M2 Money Supply in the United States is also at record high levels of $21.18 Trillion in October.

INCREASE IN FED BALANCE SHEET DUE TO QE

Source: Bloomberg

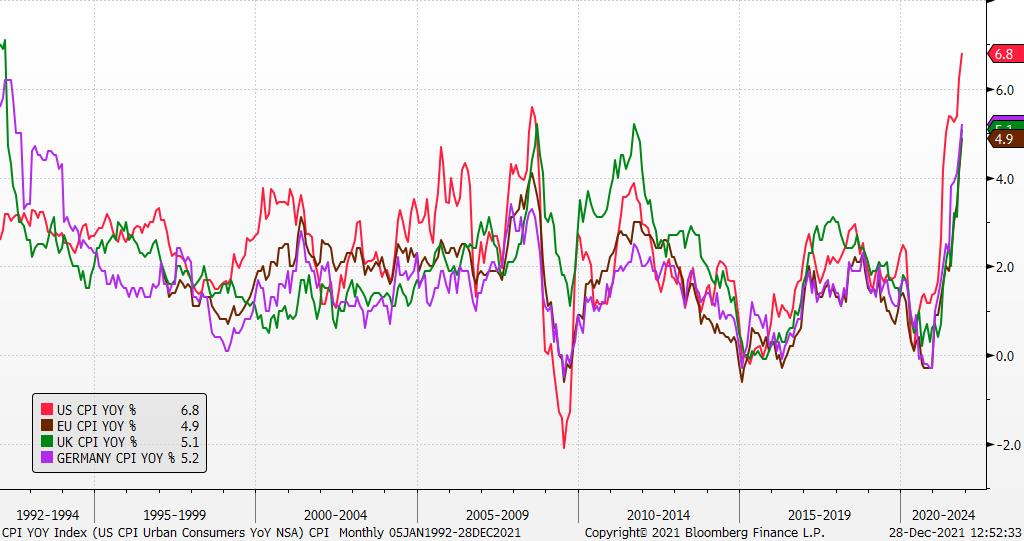

Such a high level of money printing in 2020 and 2021 has infused higher spending and boosted Inflation in the US. Quantitative Easing, money printing and stimulus also were given by the Central bank of the Eurozone. Therefore, Inflation is currently at a 39-year high of 6.8% in the United States, more than 5% in Germany, the highest level in 29 years, and 4.9 per cent in the Eurozone, the highest level since the monetary union’s inception in 1999.

INFLATION (CPI) OF DEVELOPED COUNTRIES

Source: Bloomberg

Gold may have failed to gain traction in the market in 2021, but the fundamentals of the yellow metal are set to stay positive in 2022. The gold picture for 2022 appears promising, with the first half of next year providing the best environment for gold bulls. Additional variables that may see investors renew their interest in gold include political uncertainties related to the upcoming US midterm elections, US budgetary drag, relatively persistent central bank gold purchases, and a much slower rate of the US and global recovery.

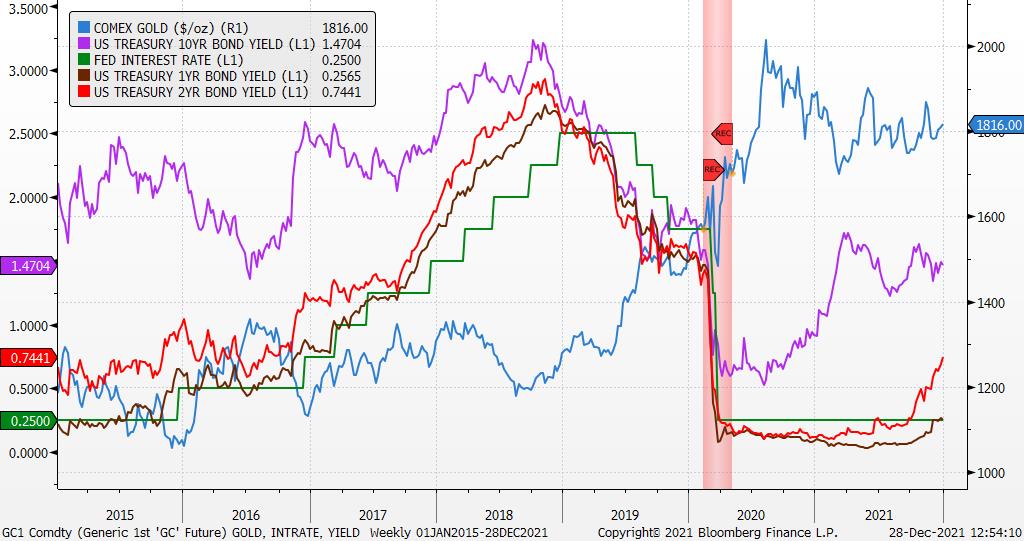

Investors should be on the lookout for the Federal Reserve to reverse course on its taper or postpone higher rates, as well as a stock market correction. The US dollar, on the other hand, may act as a headwind for gold. The interest rate differential already favours the dollar, and if the Fed raises rates while the European Central Bank and the Bank of Japan do not, the dollar will become even more appealing in comparison to other major currencies. Investors should keep a watch on the Federal Reserve’s interest rate policy and how it relates to gold. A tiny upward adjustment, even 0.25 per cent, might have a detrimental influence on gold. This, I believe, would be a short-term disadvantage.

FED INTEREST RATE AND US TREASURY YIELDS

Source: Bloomberg

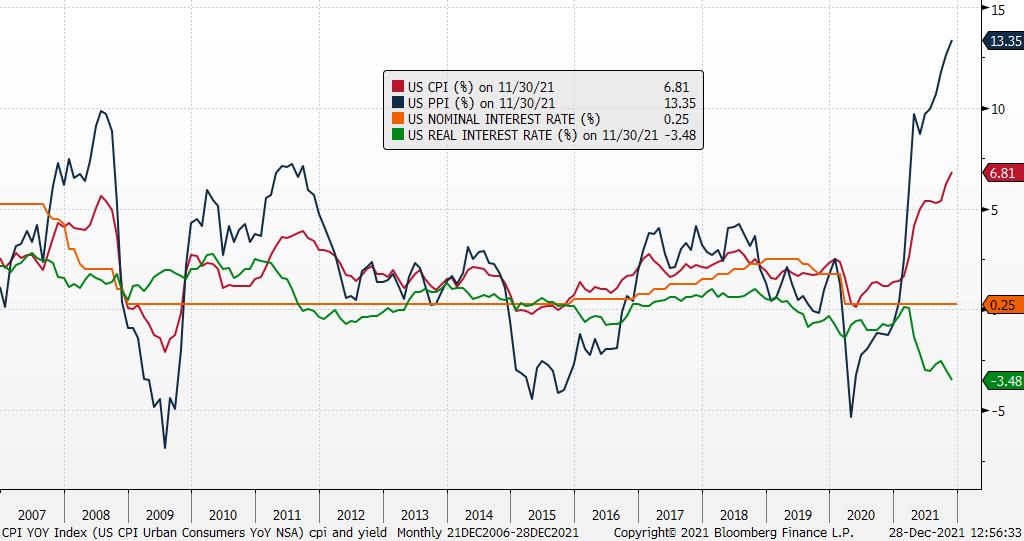

Gold generally underperforms in a rising rate environment. Many fear that a gold surge will be unachievable in 2022 when the Fed is expected to turn aggressive. However, investors should keep in mind that, due to rising inflation, the real yield remains low, if not negative. In the medium to long run, I do not expect inflation to return to the Fed’s target of 2%. If high inflation becomes entrenched and central banks fail to respond correctly, gold will very certainly benefit as an inflation hedge. I agree with the Fed that inflation will progressively decrease through 2022, but nominal Treasury rates will climb as US monetary policy and global liquidity tightening.

US NOMINAL AND REAL INTEREST RATE

Source: Bloomberg

As a result, real yields should begin to rise, putting downward pressure on gold prices. However, the ultimate goal would be to achieve a zero real rate in the next ten years, although that may not happen until 2023 or later.

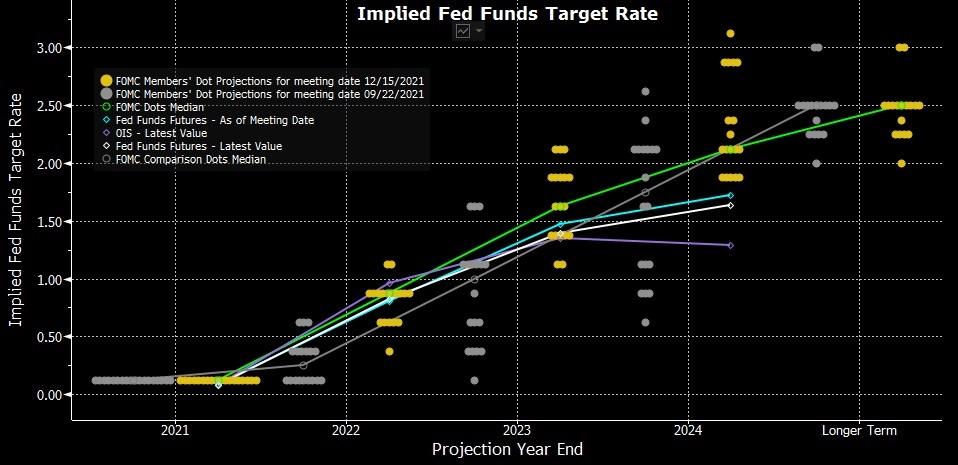

FED DOT PLOT BEFORE AND AFTER DECEMBER FED MEETING

Source: Bloomberg

The most recent quarterly survey is depicted above, with the date specified in the amber box at the upper left. The forecasts of individual FOMC members are represented by yellow dots. The green line is the median forecast of Fed officials. The white line depicts Fed funds futures rate forecasts, whereas the purple line depicts overnight interest rate swaps expectations. By the end of 2022, the FED expects 0.75 per cent, 1.5 per cent by the end of 2023, and 2 per cent by the end of 2024. Fed funds futures suggest that rates will be lower by the end of 2024, with Fed funds futures predicting a rate of 1.5 per cent. In comparison to September, the current dot plot reveals a closer consensus for 2023 and 2024. The median projection over the long run remains at 2.5 per cent.

Going forward, the most important driver for gold would be real interest rates, which are influenced by nominal interest rate and inflation forecasts. Given that equities markets are near all-time highs and there is still a huge pandemic risk, I see a compelling case for adding to gold for diversification in 2022. After a mediocre year, gold could rise in 2022, owing to a mix of lower real interest rates, US dollar performance, and demand for safe-haven assets.

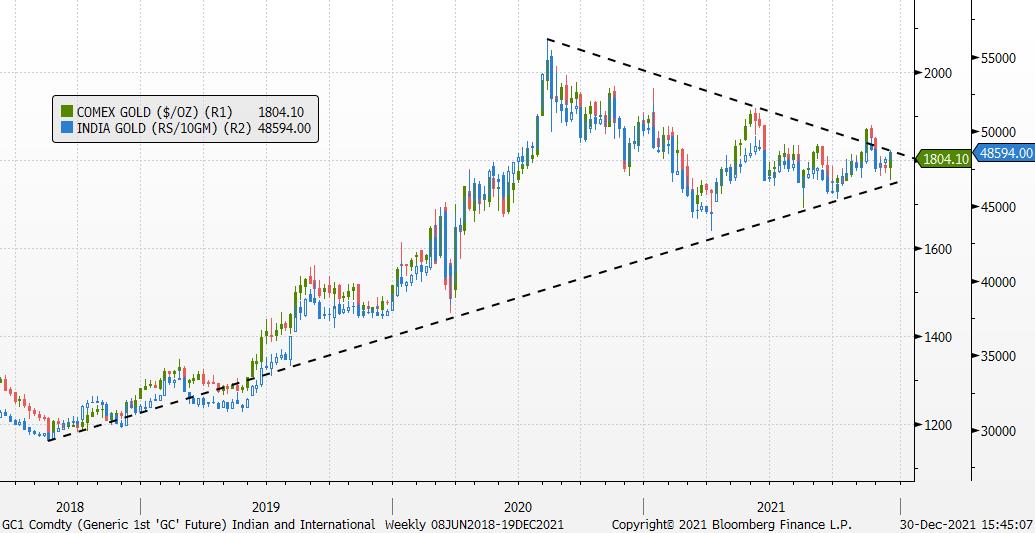

GOLD WEEKLY CHART

Source: Bloomberg

With gold currently trading around $1800, the first key level to watch is $1870, which corresponds to the peak set in November 2021. A breakthrough this barrier might trigger a rally to the historical 2011 high in the region of $1920, with the psychological $2000 mark, which led to the historical high of $2074 in July 2020, being the next significant level to watch. Similarly, in the event of a new downturn, the support zones – where we should expect strong purchasing volumes – are $1750 and $1675. We can find $1620 and the $1520 – $1500 range a little further down the road.

At domestic levels, Rs 49000 is very strong resistance, prices need to sustain above this level to head higher towards Rs 52000 and Rs 55000 while Rs 44000-45000 is a very strong support zone, which prices should not break to remain in a bull trend. The best way to stay invested in Gold is through the Augmont Digital Gold SIP where you invest a certain amount every month and get very good returns in the long-term due to cost-averaging.

Read more: Will Gold behave better in 2022?

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.