Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – Bullion prices have been making higher highs on daily charts, suggesting rebound Long-term View (3-4months) – Positive – – – Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

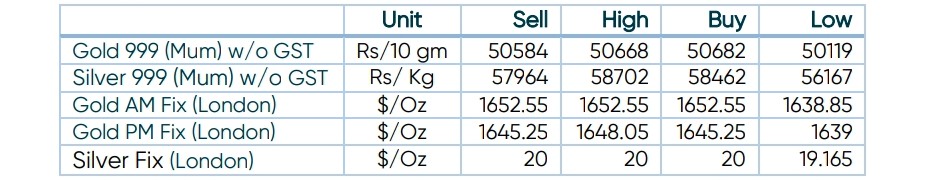

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – Following its two-day policy meeting, the US Fed is expected to raise its policy rate by 75 bps to the range of 3.75% – 4% today. The market positioning suggests that such a decision is already priced in, opening the door for a significant reaction to the US central bank’s communication regarding future policy actions.

- Indian Demand – – India bought 191.7 tonnes of gold worth Rs 85,010 crore in Q3 2022 and also defied the international gold investment trend by posting a positive gold investment figure.

Disclaimer

1 Comment. Leave new

ussu