Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold and Silver, both have broken the symmetrical triangle, next support for gold is 50000 and for Silver, it is 56000.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 56000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively by year end.

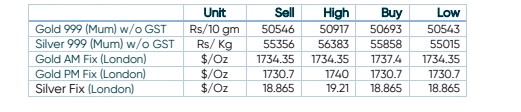

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

One Dollar = One Euro = Eighty Rupees

- International News – Euro has reached parity with US Dollar, which equals to Eighty Rupees, as Dollar Index appreciates to 20 -year high levels of 108. This all is creating pressure of precious metal prices in short-term.

- Demand and Supply – G7 countries, UK, Australia have signaled the ban of Russian gold, which produces around 300 tonnes

- Economic Data– A preliminary estimate for the US Consumer Price Index (CPI) is 8.8%, higher than the prior release of 8.6%. A higher than or within expectation release of the inflation rate will compel the Federal Reserve (Fed) to tighten its policy further and raise interest rates to 2.25-2.50%

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.