Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold is consolidating in range of 50000 and 51000, while Silver is in downtrend trading below 54000

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

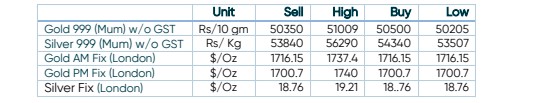

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metal fall to 27 months low on higher interest rate bets

- International News – Precious Metal tumbles to a 27-month low, as CPI for the June came in at a new four-decade high of 9.1%, bets on rates have been volatile — with the pendulum swinging between an unprecedented increase of 100 basis points for July versus the broader consensus for a 75-basis point hike.

- Demand and Supply – Fed Watch tool showed an almost 82% chance of a full percentage-point hike at the July 27 rate revision meeting of the central bank.

- Economic Data– It was plausible for the Fed funds rate to be “higher than 4% by the end of the year if data continues to come in in an unfavorable way.

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.