Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) -Rangebound–– – Gold is again trading in same range 50200 to 51200 and silver range is 59000 to 62500

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

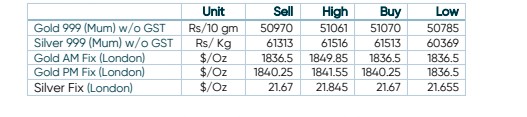

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metal prices continue to consolidate as uncertainty over Fed Powell’s testimony soars

- International News – – The Investors are hoping that Fed Powell is going to dictate an extremely hawkish stance on July monetary policy. The Fed has already elevated its interest rates to 1.50-1.75% in the last four months, however, the impact on the inflation mess is still not visible.

- Demand and Supply – – – – Investment demand remains weak. The premium for physical gold turned positive in China and India, but demand in China has been weighed down by lackluster retail jewellery sales. Indian gold imports rebounded in May driven by the traditional wedding season. That said, off-season months could see physical demand weaken.

- Economic Data – – – Fed Chair Powell’s testimony will be crucial after recent inflation fears triggered 75 bp rate hike.

- Domestic News – – Discounts on physical gold in India narrowed this week to $6, helped by some fresh buying from jewelers,