Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold and Silver, both have broken the symmetrical triangle, next support for gold is 50000 and for Silver, it is 56000.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 56000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively by year end.

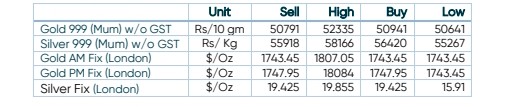

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

Dollar rally saps precious metal appeal as more Fed hikes loom

- International News – Precious metals price extends the previous day’s corrective pullback from yearly low. Softer yields offer extra strength to buyers, by exerting more downside pressure on USD. Sentiment improves as recession fears ebb on absence of major fresh catalysts.

- Demand and Supply – G7 countries, UK, Australia have signaled the ban of Russian gold, which produces around 300 tonnes

- Economic Data– Nonfarm Payrolls in US is forecast to increase by 270,000 in June. Gold is likely to react more significantly to a disappointing jobs report than an upbeat one.

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.