gold and silver – kya lagta hai

short-term view (up to 1 week) – Weakness– Gold has taken support at down trend channel again, as prices see profit-booking while Silver is continuously trading below its downtrend line from last 5 months

long-term view (3-4months) – positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

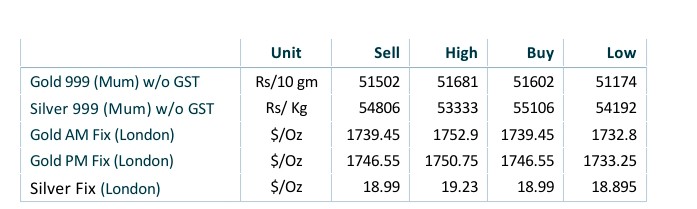

spot prices

spot gold daily price chart

spot silver daily price chart

Important news and triggers

Precious Metals catches bids with modest USD pullback

- international news – Precious Metals catches some bids and recovers further from a multi-week low. A softer risk tone, along with a modest USD pullback, offers support. Hawkish Fed expectations, elevated US bond yields should cap any further gains.

- Demand and Supply – EUR/USD declined to 0.9930 as traders rushed to sell the European currency amid severe energy crisis in the EU.

- economic data – – All eyes will be on Chair Jerome Powell when he speaks this Friday at the annual gathering of central bankers at Jackson Hole. He’s expected to re-state the Fed’s resolve to keep raising rates to get inflation under control, though he’ll probably stop short of signaling how big officials will go when they meet.

- domestic news – Indian silver demand is soaring as silver imports into India surged to 5100 tonnes in the first seven months of this year, according to data from India’s Ministry of Commerce and Industry. The country’s silver imports for the whole of last year stood at 2,773 tonnes, at 2,218 tonnes in 2020, and 5,969 tonnes in 20