Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) –Sideways to Positive-Gold is expected to trade in range of 50300 to 51800 while Silver is expected to trade in range in range of 65000 to 68000

Long-term View (3-4months) -Positive – Any dips towards 50000 and 65000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

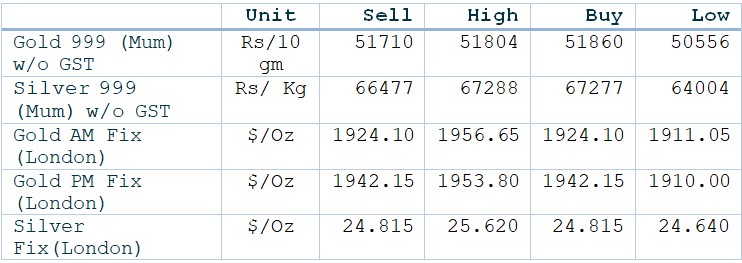

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News–Gold rises 6.5% in Q1-2022, one of its best quarters in almost two years, has reclaimed its appeal as a haven as investor worries mount over war, inflation and the outlook for the global economy

- Demand & Supply–Gold remains supported by continued buying in Global ETF with daily accumulation seen an acceleration. World total ETF Holding are at 13-month high at 3286 tonnes, up 80 tonnes during the March month

- Economic Data –US Unemployment Rate and US Nonfarm payroll Data at 6 pm today can bring volatility in the bullion prices today

- Domestic News–2nd April marks the beginning of Vikram Samvat 2079 in India, also celebrated as Gudi Padwa, Ugadi and Chetichand is expected to improve the physical jewelry demand for precious metals as it is auspicious day to buy Gold and Silver in Hindu religion.

Disclaimer