gold and silver – kya lagta hai

short-term view (up to 1 week) – Weakness– Gold has broken support at downtrend channel again, while Silver is continuously trading below its downtrend line from last 5 months

Long-term view (3-4months) – positive – – – Any dips towards 50000 and 52000 should be used as buying opportunities for the target of 55000 and 60000 for Gold and Silver respectively by year end.

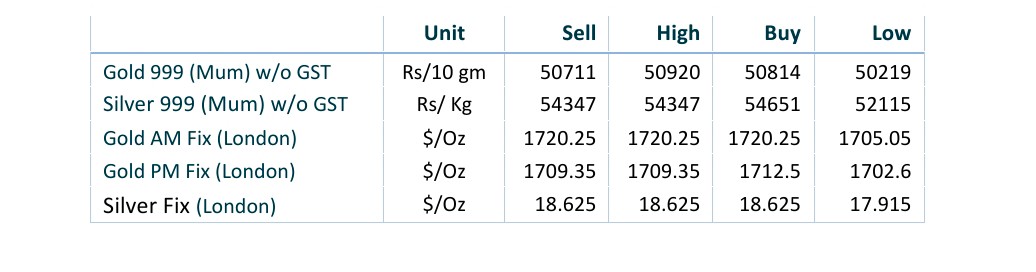

spot prices

spot gold daily price chart

spot silver daily price chart

Important news and triggers

Precious Metals consolidates at lows, inflation data in limelight

- International news – The precious metals prices witnessed a vertical drop after a hawkish speech from Federal Reserve (Fed) chair Jerome Powell. Fed Powell is ‘strongly committed to bringing price stability with odds of lower sacrifice in overall demand against prior instances of fighting inflation. Esteemed jobs demand sacrifices from growth prospects and the Fed is set to go all in to fix the inflation chaos.

- Demand and Supply – – The Fed is largely expected to deliver a 75-basis point rate increase later this month. The U.S. central bank has raised its benchmark overnight interest rate by 225 basis points in total since March to fight soaring inflation.

- Economic data – – – The ECB is this week expected to deliver a second big rate hike to tame record-high inflation just as a halt in supplies from a major Russian gas pipeline fans further inflation and recession fears in Europe.