Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold is able to sustain above downtrend channel after 4 months while silver is on the verge of crossing the downtrend line

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

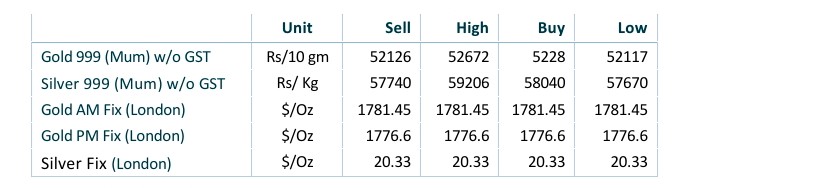

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals dips as dollar firms, FED rate-hike fears linger

- International News – Precious metals slipped, weighed down by a rebound in the U.S. dollar and expectations of further interest rate hikes from the Federal Reserve to tame high inflation.

- Economic Data – Investors will be watching out for minutes from the Fed’s last monetary policy meeting due on Wednesday for more clues on future rate hikes.

- Demand and Supply – Traders were pricing in around a 44.5% chance of a 75-basis-point rate hike by the Fed in September and a 57.5% chance of 50 bps.

- Domestic Demands – The Reserve Bank of India (RBI) added 13.4t of gold in July, increasing its total gold reserves to 783.1t. Official imports declined to 42.5t in July, 41% lower y-o-y due to weak retail demand.